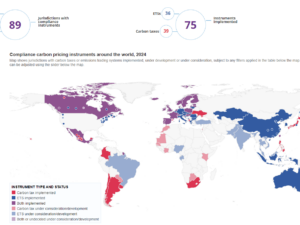

Media Release: December 12: 2016, Contact: Cathy Orlando cathy@citizensclimatelobby.org 705-929-4043 Sudbury ON: On Friday, December 9, 2016, the Pan-Canadian Plan on Clean Growth and Climate was signed by all Premiers at the First Minister’s Meeting (FMM) except the Premiers of Manitoba and Saskatchewan. The plan includes a pan-Canadian approach to pricing carbon pollution and measures to achieve reductions across all sectors of the economy. It also aims to drive innovation and growth – increase technology development and adoption to ensure Canadian businesses are competitive in the global low-carbon economy. Missing from the plan are border tax adjustments for carbon pollution which would directly address Premier Brad Wall’s primary concern about a national carbon tax. Since March 2016, Saskatchewan Premier Brad Wall has steadfastly opposed any sort of carbon pricing. He is claiming it would be foolish to impose a levy with the imminent arrival of president-elect Donald Trump to the White House. Trump has vowed to dismantle many of the climate-friendly regulations implemented by President Barack Obama, and he appointed a climate change sceptic to head the country’s Environmental Protection Agency, Wall noted. “I’m just saying, let’s not be naive as Canadians. This is our number one not just trading partner but a competitor for investments in energy … and we need to be competitive with them. And that’s some of the concerns we have,” Wall said. A big purpose of a nationally rising carbon price is to send a market signal to invest in Canada’s clean tech sector, which in turn will help us reduce emissions and grow our economy. This would give Canada a leg up on the U.S. once our neighbour wakes up to the reality of rapidly changing energy landscape. According to a recent federal-government study prepared by Policy Horizons Canada – a government forecasting office – we could be a decade away from an era when renewable and alternative-energy sources are significantly cheaper than fossil fuels, making Canada’s fossil fuel sector a minor player in our overall economy. Why? Worldwide pricing and technology and policy trends are driving the price of non-fossil electricity sources downward at a far faster pace than expected. We are also seeing rapid technology-driven decreases in the price of grid-level energy storage and alternative-energy vehicles, manufacturing and heating. Canada’s clean tech sector is poised to become a global player in this rapidly growing industry. Now is not the time to get cold feet on the government’s proposed national carbon tax. Wall has expressed concerns about losing a competitive advantage to the USA if Canada has a carbon tax and they do not. This can be avoided by imposing a border tax adjustment. A carbon tax on imported carbon intensive goods like steel and cement will level the playing field for carbon-intense and trade exposed Canadian industries. In fact, France’s past president, Nicolas Sarkozy has already suggested imposing a carbon tax on the USA if Trump scraps the Paris Climate Act. National Director of Citizens’ Climate Lobby Canada, Cathy Orlando said the following, “I urge Premier Brad Wall to have his advisors study border tax adjustments. As well, the next phase of the Pan-Canadian Plan on Clean Growth and Climate should include border tax adjustments as we cannot find information about them online.” Canada is a member of the Carbon Pricing Leadership Coalition, convened by the World Bank President and International Monetary Fund Managing Director to strengthen carbon pricing policies amongst the participating members. A border tax adjustment on carbon very possibly could enhance the efforts of other members of the Carbon Pricing Leadership Coalition to price greenhouse gas emissions within their own jurisdictions. Citizens’ Climate Lobby has developed a one-pager on carbon border tax adjustments. Although developed for a U.S. audience, one can glean from it the general contours of a GATT compliant border tax adjustment on carbon. On November 28 and 29, 2016, fifty-three Citizens’ Climate Lobby volunteers lobbied forty-seven offices on Parliament Hill for improvements to Canada’s national carbon pricing policy. One of their five recommendations was, “Border tax adjustments must be included in the policy to level the playing field for domestic industries with international jurisdictions without a similar carbon price.” ###### The Solution is Border Tax Adjustments Premier Wall

MEDIA RELEASE: The Solution is Border Tax Adjustments Premier Wall

Home » CCL Canada News » MEDIA RELEASE: The Solution is Border Tax Adjustments Premier Wall

MEDIA RELEASE: The Solution is Border Tax Adjustments Premier Wall

Posted on December 12, 2016 in Media Release