The Basics of Climate Income

What is Climate Income?

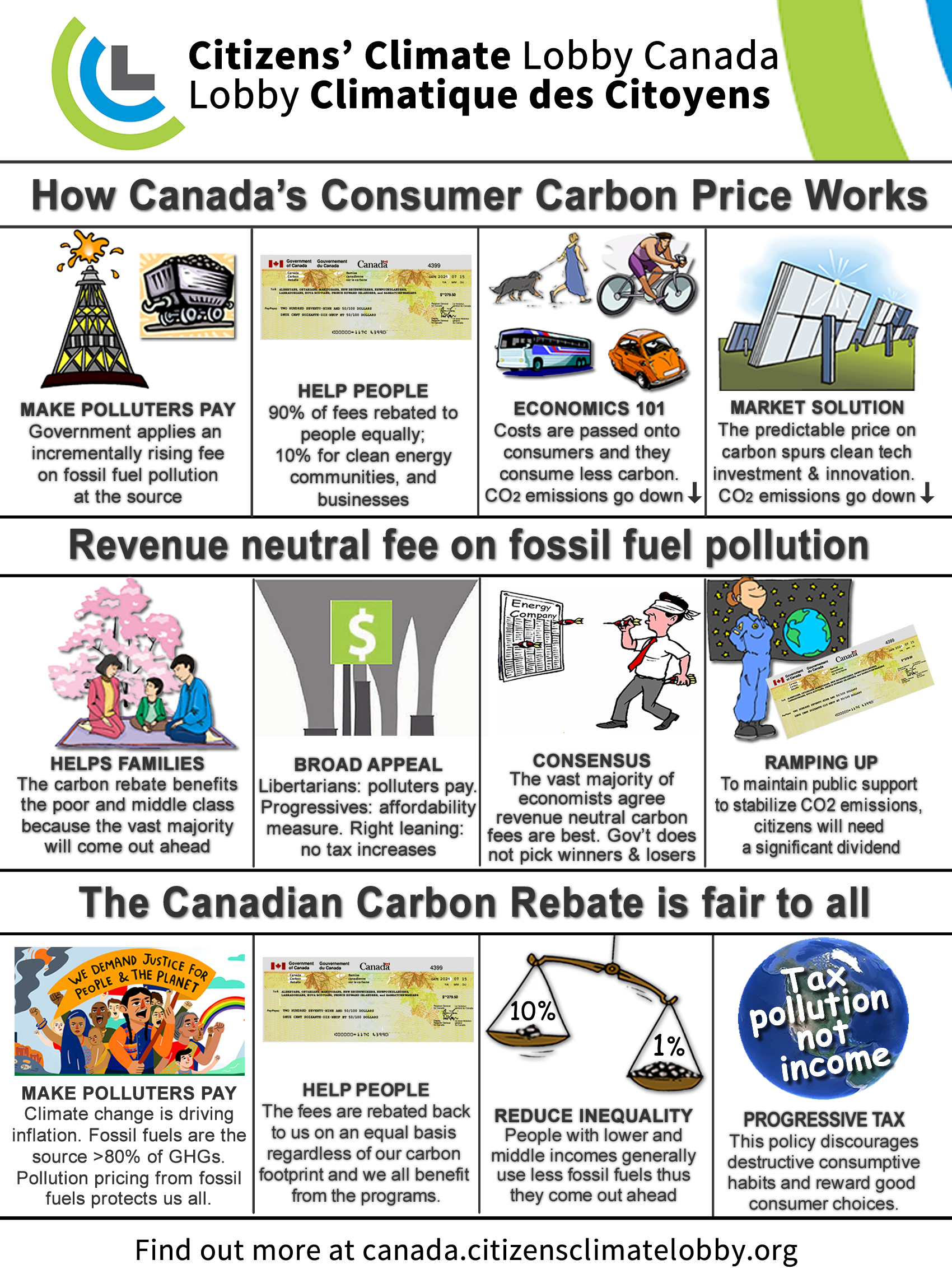

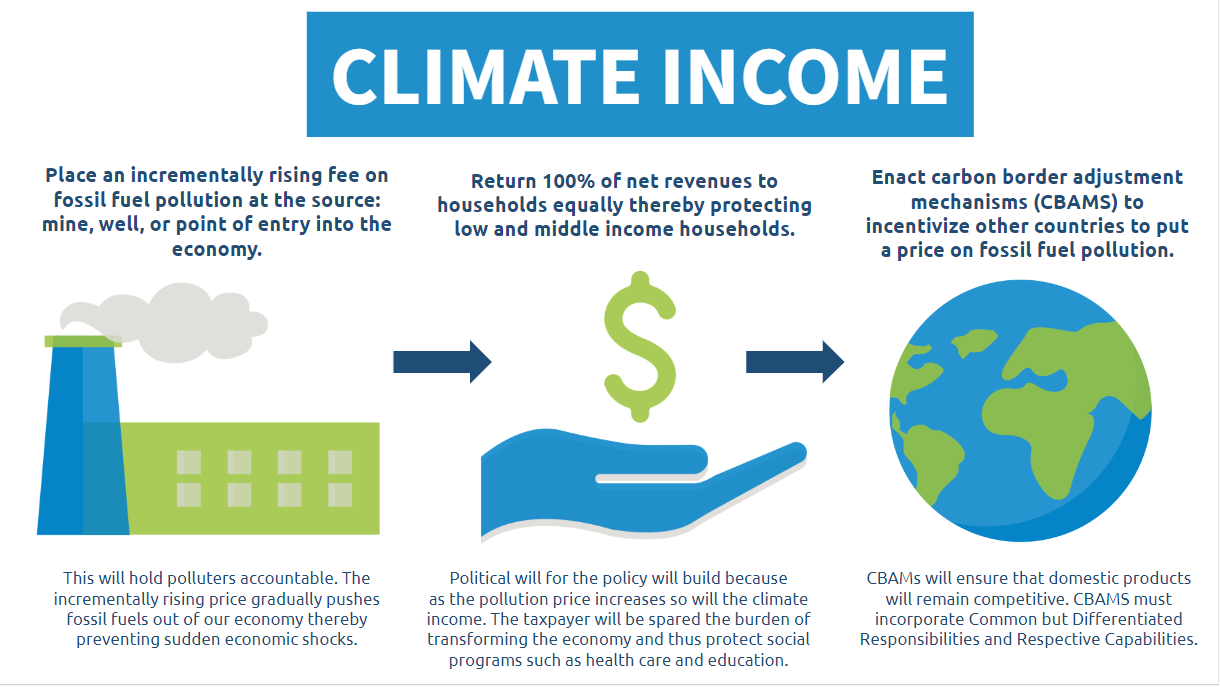

Climate Income (a.k.a. Carbon Fee and Dividend) is the policy proposal created by Citizens’ Climate Lobby (CCL) to internalize the costs of burning carbon-based fuels. It is a national carbon price, with full revenue return and Carbon Border Adjustments Mechanisms (CBAMS).

Why Climate Income?

As long as fossil fuels remain artificially cheap and profitable, their use will rise. Correcting this market failure requires their price to account for their true social costs. To be effective, the carbon price must rise well above $100 tonne by 2030 and the burden of transitioning must not be put on households. That is why since 2010 we have advocated returning the revenues collected back to households.

Where has it been enacted?

Canada’s Greenhouse Pollution Pricing Act is a form of Climate Income but instead of Carbon Border Adjust Mechanisms (CBAMS), we have output based carbon pricing for heavy emitters. Currently, Austria has a Klimabonus, and Switzerland are versions Climate Income too. Note that Canada is exploring CBAMS with international partners.

Climate Action Makes Our Lives More Affordable

Taking action on the climate crisis will enhance the affordability of our lives. The climate crisis has already inflicted a staggering cost of $16 million per hour in extreme weather damages over the past two decades. Climate Income policies as we have in Canada, further improves the affordability of climate action.