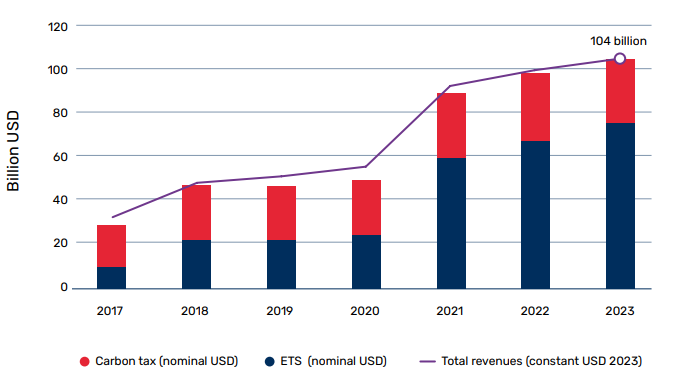

IMAGE SOURCE: World Bank’s Carbon Pricing Dashboard:

Carbon Pricing Around the World (July, 2024)

Around the world, carbon pricing initiatives are driving emission reductions that cause climate change. Using data from 142 countries over two decades, researchers found that the average annual growth rate of CO2 emissions from fuel combustion in countries with a carbon price to be 2 percentage points lower compared to countries without a carbon price (Carbon Pricing Efficacy: Cross-Country Evidence, 2020). Further, an additional euro per tonne of CO2 is associated with a reduction in the subsequent annual emissions growth rate of approximately 0.3 percentage points, all else equal.

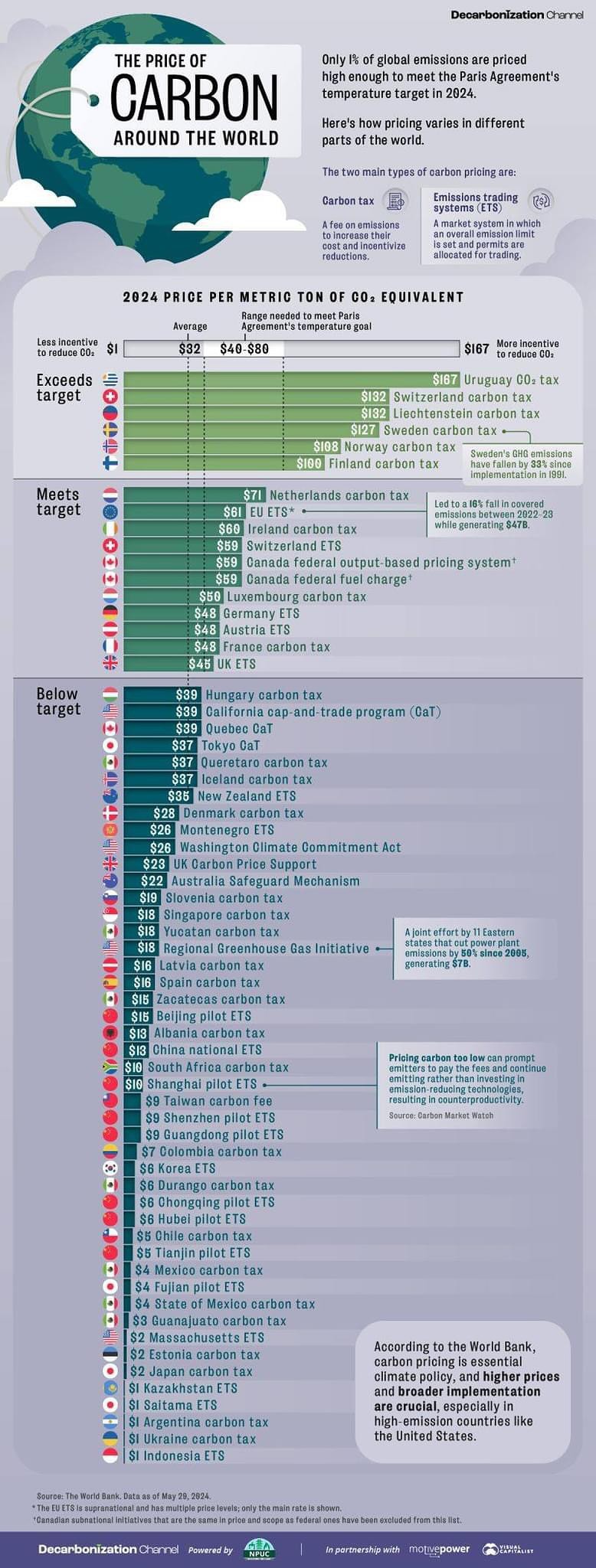

Carbon pricing initiatives have been implemented or scheduled for implementation in 89 jurisdictions. This includes 50 national initiatives and 39 subnational initiatives. In 2024, these initiatives cover 12.8 GtCO2e, representing 24 % of global GHG emissions. However, only 1% of global emissions currently covered by a carbon price are within the price range needed by 2030. Prices must rise considerably to meet the Paris Agreement temperature goal of 1.5 degrees.

For the most up-to-date information, visit the World Bank’s Carbon Pricing Dashboard.

Important initiatives that will drive global carbon pricing:

- The World Bank, and several country launched the Partnership for Market Implementation which will assist countries in the Global South in either improving their current carbon pricing or implementing carbon pricing at COP 26 in Glasgow .

- On June 6, 2022, Canada and Chile, two countries that have implemented a carbon tax, issued an agreement to accelerate the adoption of carbon pricing around the world.

- On May 16, 2022, Canada and the EU issued a joint declaration confirming the willingness of the EU and Canada to coordinate on respective approaches to carbon pricing and carbon border adjustments to prevent carbon leakage. They also confirmed the intention of the EU and Canada to work together to engage international partners to expand the global coverage of carbon pricing.

- The European Union enacted border carbon adjustments by January 2023 to go into effect in 2026.

- The following was stated in the 2024 World Bank’s States and Trends of Carbon Pricing report:

“CBAM payments will be required from 2026, which has spurred governments to consider implementing carbon pricing to reduce potential CBAM costs. Countries including India, Indonesia, Morocco, Türkiye, Ukraine, Uruguay, and Western Balkan countries, have implemented, adjusted, or are considering implementing direct carbon pricing to reduce CBAM compliance costs and to capture revenue that would otherwise be paid to the EU.”In short, the EU is acting as a leader on carbon pricing, and moving other countries to follow suit thanks to CBAM. Looks like hitting the wallet is what makes things move forward!