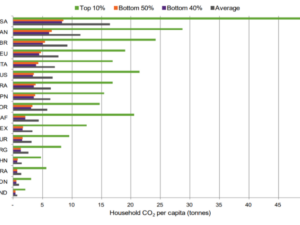

CCL Canada’s December 2021 Submission the Net Zero Advisory (pdf) Thank you for the opportunity to provide evidence-based information for Canada’s 2030 emissions reduction plan. About Citizens’ Climate Lobby Aligned with Article 12 of the Paris Agreement Shared Minimum Global Standard for Pricing Pollution We Need the Government to Enact Laws to Protect Us There are now only 96 months left to achieve the goal of reducing GHGs by 50% globally by 2030 and the United Nations Sustainable Development Goals (SDGs). Thus, we need to make sure all commitments become the law of the land and that we enact more evidence-based and socially-just policies. Cap Emissions in the Oil and Gas Sector Increase the Carbon Price Canada’s national backstop carbon pricing policy is laudable in how it recycles revenue back to households. It puts people first because it alleviates income inequality in addition to being a powerful policy to cut GHG emissions. In 2030, households earning less than $86,000 will come out ahead financially under Canada’s backstop policy. https://cleanprosperity.ca/liberal-climate-plan-has-reasonable-chance-of-meeting-2030-target/ Recent research using the Nested Inequalities Climate Economy (NICE) model published in Nature found that if all countries adopted the same tax on carbon emissions and returned the revenues to their citizens, it would be possible to keep the global temperature from rising more than 2℃, while also benefiting well-being, reducing inequality, and alleviating poverty. Thus, continue to recycle revenue back to households and also consider being more ambitious with the carbon price. https://www.nature.com/articles/s41558-021-01217-0 Economy-wide carbon pricing 1. Add Volatile Anaesthetics to the Greenhouse Gas Inventory Case Study: In 2020, Health Sciences North (HSN) in Sudbury ON removed desflurane from the formulary. The implementation of this measure was associated with a significant drop in carbon dioxide equivalents from volatile gases by 723 tonnes in just that one hospital. Currently, very few Canadian hospitals have banned desflurane. Thus, given this compelling data, Citizens’ Climate Lobby Canada is asking that volatile anaesthetics be included in Canada’s Greenhouse Gas Inventory 2. Remove Natural Gas Produced Electricity from the Output-Based Pricing System Border Carbon Adjustments Research done by Canadians for Clean Prosperity found that an economy-wide carbon price with BCAs could get Canada past our previous Paris Agreement commitments. To have such a policy, this will require border carbon adjustments. https://www.cleanprosperity.ca/wp-content/uploads/2020/12/Creating_Clean_Prosperity_Nov2020.pdf Trade is a barrier to rising the carbon price domestically and BCAs could be a forcing function towards achieving PM Trudeau’s stated goal on November 2, 2021 “to ensure it’s no longer free to pollute anywhere around the world. That means establishing a shared minimum standard for pricing pollution.” We have always viewed the output based pricing system (OBPS) as temporary. The Parliamentary Budget Office in June 2021 reported that BCAs and OBPS are substitutes since they both seek to level the playing field between Canada and the rest of the world. In practice, however, they are both complements and substitutes, and using both creates significant complications. We are pleased to see the Canadian Institute of Climate Choices had discussions open to the public with the German Missions in Canada and the Delegation of the European Union to Canada on Wednesday, December 15, 2021 and that in March 2021 Canada’s Permanent Mission at WTO hosted a discussion on border carbon adjustments as well. Finally, we are pleased to see border carbon adjustments explicitly stated in the Prime Minister and Finance Minister’s mandate letters. Harmonization of Carbon Pricing in Canada Mobilizing Finance We were happy to read that in October 2021 that some of Canada’s biggest banks including BMO, Royal Bank of Canada and TD all joined the Net Zero Banking Alliance too. https://www.unepfi.org/net-zero-banking/members/ But the clock is ticking for banks, insurers and asset managers still providing support to oil, gas and coal producers. According to Moody’s Investors Service, financial institutions in the Group of 20 leading industrial and developing nations have $22 trillion of exposure to carbon-intensive industries. That’s equal to about 20% of their total loans and investments. The aspirations of the financial community at COP26 were empowering to read but there is a vacuum of responsibility that can delay or prevent the financial transition. The government has to create policies to steer the financial institutions in the right direction. In April 2021, New Zealand introduced a law that will force financial firms to assess not only their own investments, but also to evaluate the companies they are lending money to, in terms of their environmental impact. Canada needs to enact similar policies: https://phys.org/news/2021-04-world-zealand-banks-climate-impact.html Tax Reform More specifically, tax reform could include: 1. Tightening tax havens: The Parliamentary Budget Officer calculated that in 2018, Canadian corporations may have avoided $25 billion dollars or more in taxes through tax havens. 2. One time tax on extreme wealth: The Parliamentary Budget Office recently reported that a one-time 3% tax on Canadians with net wealth over $10 million, and a 5% tax on net wealth over $20 million could raise up to $82.5 billion over five years. 3. End Subsidies to Fossil Fuels: Recent data from the Parliamentary Budget Office (PBO) found that Ottawa’s tax breaks to the fossil fuel sector found that from 2015 to 2019, tax deductions related to fossil fuel exploration, development, property expenses and other measures averaged $1.8 billion annually. Our submission is not meant to provide an exhaustive list of all the policies necessary to transform our economy, avoid disaster and lift up everyone. Thus, we look forward to reading submissions and engaging with other stakeholders in this process. Canadians can achieve our 1.5℃ and Sustainable Development Goals by 2030. The best way to achieve them will be by cooperating and listening to the experts. Thank you for leading us all. Truly, Cathy Orlando Andy Kubrin Rainer Fehrenbacher Alex Neufeldt Brian Cho Cheryl McNamara Gerry Labelle You can find more information online, including questions and answers.Citizens’ Climate Lobby’s Submission to Canada’s Net-Zero Advisory Body

Set a Course to Achieve Our 1.5C goals and SDGs by 2030

Citizens’ Climate Lobby (CCL) Canada is a volunteer-driven and non-partisan organisation. Since 2010, we have been focused on creating the political will for a liveable world in Canada. To date, we have 42 active chapters covering over 120 ridings across the country and have met with government officials well over 1200 times. We also belong to a network of CCLers in over 75 countries and have been an active member of Climate Action Network Canada since 2011.

https://canada.citizensclimatelobby.org/ and https://citizensclimate.earth/regions/

The Canadian confederation is akin to the UNFCCC in that it also has common but differentiated responsibilities. Thus, the consultative process of the government and your advisory body are very important in creating a path together and is in alignment with Article 12 of the Paris Agreement. Canadians are role-modelling to the world an inclusive and collaborative approach.

Citizens’ Climate Lobby was pleased that Canada pushed for the polluter pays principle at COP26. We were especially empowered by this bold and proactive statement from PM Justin Trudeau on November 2, 2021: “Just as globally we’ve agreed to a minimum corporate tax, we must work together to ensure it’s no longer free to pollute anywhere around the world. That means establishing a shared minimum standard for pricing pollution.”

A member of CCL Canada, who is also a Climate Interactive EnROADS ambassador, reported the following last week:

Following COP26, the International Energy Agency and Climate Action Tracker showed:

– continuing with current policies would lead to a 2.6 – 2.7 C temperature rise by 2100

– adding in all the commitments for 2030 would lead to an increase of 2.3 – 2.4 C

– further adding in the commitments to net-zero would lead to an increase of 1.8 C

https://www.iea.org/commentaries/cop26-climate-pledges-could-help-limit-global-warming-to-1-8-c-but-implementing-them-will-be-the-key

https://climateactiontracker.org/documents/997/CAT_2021-11-09_Briefing_Global-Update_Glasgow2030CredibilityGap.pdf

The election promise to cap to “make sure the O&G sector reduces emissions from current levels at a pace and scale needed to achieve net-zero by 2050 with 5-year targets starting in 2025” must become the law of the land.

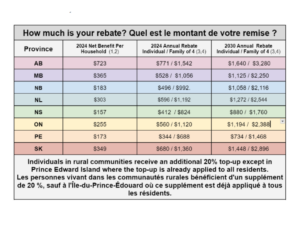

We support the federal government’s announced intention to gradually increase the federal carbon price to $170 per tonne by 2030 and that the rebates will be in the form of quarterly dividends. Furthermore, we are now recommending the government study the following carbon prices in the context of complementary policies also enacted: $210 by 2030 (Ecofiscal Canada recommendation) to $295 by 2035 (Toronto Atmospheric Fund recommendation).

https://www.canada.ca/content/dam/eccc/documents/pdf/climate-change/climate-plan/healthy_environment_healthy_economy_plan.pdf

Revenue Recycling Back to Households and Income Inequality

Our fair country has an income inequality problem. The top 1.0 % of Canadian families possess more than a quarter of all wealth in Canada, whereas the bottom 40% possess just 1.2% of Canadian wealth.

https://www.pbo-dpb.gc.ca/web/default/files/Documents/Reports/RP-2021-007-S/RP-2021-007-S_en.pdf

Citizens’ Climate Lobby has always recommended that the carbon price must be economy-wide with minimal, principled exceptions. We have specific recommendations:

At COP26, Canada signed onto the WHO COP26 initiative to build resilient, low-carbon health systems. This is a significant development because 4% of GHG emissions in Canada come from the health care system. It is well established that volatile anaesthetics are potent greenhouse gases (GHG) and that desflurane is responsible for a significant portion of the carbon footprint of the operating theatre.

https://www.who.int/news/item/09-11-2021-countries-commit-to-develop-climate-smart-health-care-at-cop26-un-climate-conference

https://www.who.int/initiatives/cop26-health-programme

https://canada.citizensclimatelobby.org/ccl-canada-ed-call-adding-anaesthetics-to-the-ghg-inventory/

Being that it is neither emissions-intensive nor trade-exposed, natural-gas produced electricity must be removed from the Output-Based Pricing System and so that generators pay for all their GHG emissions, immediately. Currently, the Greenhouse Gas Pollution Pricing Act and provincial regulations for big emitters in Alberta, Ontario and New Brunswick permits existing gas plants and those converted from coal to emit most of their GHGs for free. The current system is not incentivizing clean energy production. This recommendation should result in the displacement of natural gas electrical generation by renewables—with a reduction of up to 15 Mt of GHGs per year achieved in Ontario alone. Full details here: https://canada.citizensclimatelobby.org/media-packet-stop-the-dash-to-gas-and-green-the-grid/

We have been advocating for border carbon adjustments (BCAs) since 2010. In 2021, volunteers are currently doing so not only in Canada but in over 70 countries around the world. We are adamant that the government enact BCAs and work with trading partners to have them implemented by 2025 at the latest.

https://distribution-a617274656661637473.pbo-dpb.ca/1df9b64ac4e1885028a02c05d5f15b82622d3ace28a473159d59301fb636c6e3

https://climatechoices.ca/events/border-carbon-adjustments-do-countries-need-to-cooperate-on-uncooperative-cbas/

https://pm.gc.ca/en/mandate-letters/2021/12/16/deputy-prime-minister-and-minister-finance-mandate-letter

We applaud the government’s intentions to review the standards used to assess provincial carbon pricing systems, and engage with provinces and territories as well as with Indigenous peoples in this review. Strengthening and harmonisation of carbon pricing across jurisdictions will be necessary to ensure our carbon pricing policies comply with international trade laws including border carbon adjustments.

Private financial institutions with over US$130 trillion in assets united behind a common goal at COP26 to accelerate progress toward a net-zero emissions future including Canada in the Glasgow Financial Alliance for Net Zero. https://www.gfanzero.com/

https://www.moodys.com/research/Moodys-Financial-firms-that-take-rapid-predictable-pace-to-zero–PBC_1305598

Canada has not had a tax overhaul in over 50 years. Canada can address the climate crisis and income inequality through tax reform. Overall we ask the government of Canada to follow the advice of experts: https://www.cpacanada.ca/en/news/canada/2019-08-12-budget-2020-recommendations

https://www.pbo-dpb.gc.ca/web/default/files/Documents/Reports/2019/Preliminary-Findings-International-Taxation/Report%20final.pdf

https://distribution-a617274656661637473.pbo-dpb.ca/a2d27dbe13ecedf7ebdac816acc5ddb4ab59d297dcbd77caddd75a346472afb7?fbclid=IwAR0Mf7BebgzBQT5osWxwvottnMsaDykcvV_lE6fm4oLdoYiXZdjHcGmNYzs

https://www.pbo-dpb.gc.ca/en/blog/news/RP-2122-022-M–energy-sector-agriculture-federal-revenue-forgone-from-tax-provisions–secteur-energie-agriculture-recettes-auxquelles-renonce-gouvernement-federal-titre-certaines-disposi

Other Policies

In the Parliamentary Budget Office document, Beyond Paris: Reducing Canada’s GHG Emissions by 2030 (June 2021), the take-home message was that carbon pricing is going to do a lot of the heavy lifting to reduce GHG emissions by 2030, but it can’t do it alone. https://distribution-a617274656661637473.pbo-dpb.ca/1df9b64ac4e1885028a02c05d5f15b82622d3ace28a473159d59301fb636c6e3

National Director of Citizens’ Climate Lobby Canada

Sudbury ON

Primary Contact: cathy@citizensclimatelobby.org

Group Leader, Citizens’ Climate Lobby

Calgary AB

Group Leader, Citizens’ Climate Lobby

Abbotsford BC

Group Leader, Citizens’ Climate Lobby

Ottawa ON/Gatineau QC

Group Leader, Citizens’ Climate Lobby

Halifax NS

Founder, Citizens’ Climate Lobby Toronto

Founding Board Member, Citizens’ Climate Lobby Canada

Toronto ON

Founding Board Member, Citizens’ Climate Lobby Canada

Group Leader, Citizens’ Climate Lobby

Stephenville NLHow to provide input to Canada’s NZAB

Open Letter: Our Advice to Canada’s Net-Zero Advisory Body

Home » CCL Canada News » Open Letter: Our Advice to Canada’s Net-Zero Advisory Body

Open Letter: Our Advice to Canada’s Net-Zero Advisory Body

Posted on December 17, 2021 in Open Letter