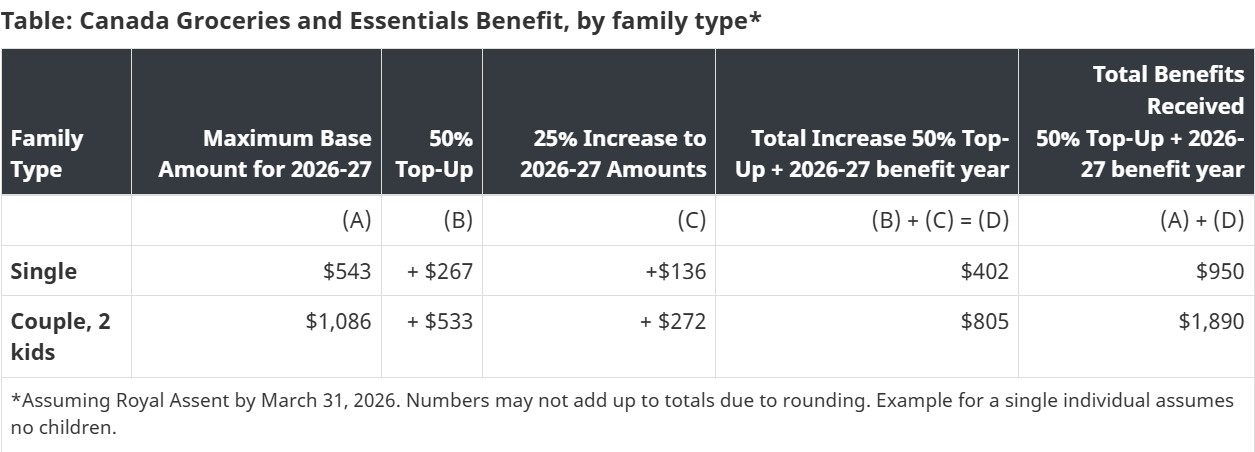

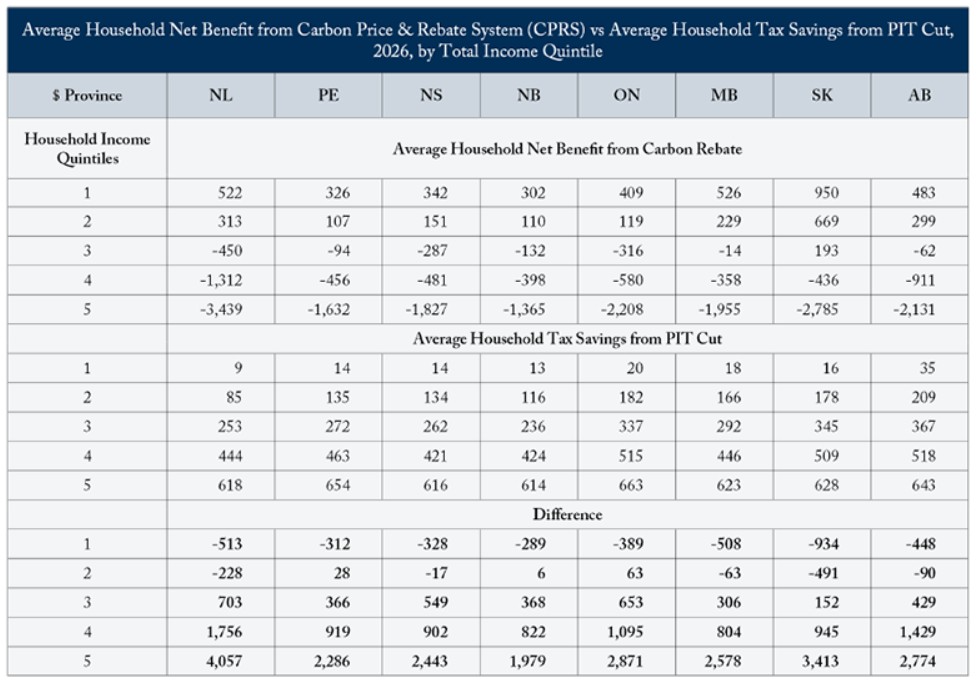

For Immediate Release: January 27, 2026 Sudbury ON in Robinson-Huron Treaty Territory: Affordability has become the defining issue of this political cycle, with housing insecurity, grocery inflation, high interest rates, and rising household debt creating sustained pressure for Canadians. Citizens’ Climate Lobby Canada welcomes the newly announced Canada Groceries and Essentials Benefit, which boosts the GST Credit by 25 per cent on an ongoing basis and adds a one-time 50 per cent top-up in 2026. For a single adult without children, support rises from $543 to $950; for a couple with two children, it rises from $1,086 to $1,890. However, nearly two-thirds of this increase comes from the one-time top-up. Image source: https://www.canada.ca/en/department-finance/news/2026/01/the-new-canada-groceries-and-essentials-benefit.html For many low-income households, the enhanced GST benefit does not replace the abolished carbon pricing rebate, leaving them hundreds of dollars worse off in 2026 once the one-time top-up is excluded. Analysis by Nicholas Dahir (C.D. Howe Institute) and Leslie Shiell (University of Ottawa) using Parliamentary Budget Office data, estimates that under the carbon rebate program in 2026, low-income households (bottom income quintile) would have received net benefits from the carbon rebate ranging roughly from $302 to $950 depending on which province they lived in. Image Source: https://cdhowe.org/publication/from-rebate-to-rate-cut-low-income-households-lose-out/ Moreover, the replacement of the carbon rebate with personal income tax cut (dropping the lowest federal rate from 15 per cent to 14 per cent) delivered minimal benefit for low-income households, as most of their tax reductions are offset by reduced non-refundable credits, resulting in less than ~$40 of tax savings on average for the bottom quintile. Citizens’ Climate Lobby Canada urges the government to re-evaluate the impact of removing carbon rebates and ensure future policies support both climate action and low-income Canadians. For those wishing to learn more about the impacts of the cancellation of the Carbon Rebate on low income families, Citizens’ Climate Lobby Canada is hosting a call with Dr. Leslie Shiell Thursday, February 19, 2026 at 5 pm PT / 8 pm ET. Register on Zoom. Media Contact:New GST Benefit Fails to Replace Carbon Rebate for Low-Income Canadians

For many low-income households, the enhanced GST benefit does not replace the abolished carbon pricing rebate, leaving them hundreds of dollars worse off in 2026 once the one-time top-up is excluded.

Cathy Orlando, National Director

Citizens’ Climate Lobby Canada

cathy@citizensclimate.org | 705-929-4043

MEDIA RELEASE: New GST Benefit Fails to Replace Carbon Pricing Payments for Low-Income Canadians

Home » CCL Canada News » MEDIA RELEASE: New GST Benefit Fails to Replace Carbon Pricing Payments for Low-Income Canadians

MEDIA RELEASE: New GST Benefit Fails to Replace Carbon Pricing Payments for Low-Income Canadians

Posted on January 28, 2026 in Media Release