Get ready to step out of your comfort zones and join an incredible team from across Canada to help steer finances towards a sustainable and fair world! Citizens’ Climate Lobby Canada is organizing a CAFA-Senate Phone Zap and Lobbying campaign. There will be empowerment, training, team building, and intel-sharing on Zoom, happening on the first Sunday of October, November, and December at 5 pm PT/8 pm ET. Together, we can make a powerful impact! Register now. Background: In March 2022. the Climate Aligned Finance Act (Bill S-243) was introduced by Senator Rosa Galvez in Canada. The bill aims to ensure that financial institutions, like banks and pension funds, align their investments with Canada’s climate goals. It is important because it prevents these institutions from funding projects that worsen climate change, helping Canada meet its climate targets. Note we are not zapping and lobbying for all aspects of the leglislation – just aspects of it based on advice from experts we are leaning into. Please bookmark this page. Bilingual resources will be posted here. LASER TALK: Support for Climate Aligned Finance Act CAFA is endorsed by over 120 civil society organizations and academics. MPs from four different parties have backed a parliamentary motion urging the government to use legislative and regulatory tools to align Canada’s financial system with the Paris Agreement. Furthermore, the Climate Aligned Finance Act (Bill S-243, also known as CAFA) is supported by five petitions in the House of Commons. LASER TALK: Keeping Pace with Global Peers Within Canada, provinces like Quebec have taken proactive steps, presenting a valuable opportunity for federal-provincial alignment on climate initiatives. In addition, CAFA enjoys an endorsement from international experts such as Eric Usher (Head, UN Environment Program Finance Initiative) and Thierry Philipponat (Chief Economist at Finance Watch). LASER TALK: The Policy Canada Needs Hello, Senator [Name], My name is [Your Name], and I’m a member of Citizens’ Climate Lobby Canada, calling from [City/Province]. I’m reaching out to urge you to vote in favor of Bill S-243, the Climate-Aligned Finance Act (CAFA), currently before the Senate Banking Committee. As a senator, your constitutional duty is to protect minorities who are not well represented in the elected chamber. No group is more vulnerable and less protected than children and future generations. Swift, bold climate action is essential to protecting them, and CAFA the missing link in aligning Canada’s financial sector with our climate goals. <<<If you’re part of the Senators for Climate Solutions, I hope you recognize Bill S-243 as a key climate solution. After over a year of being stalled in committee, I urge you to help move this bill forward.>>> Most Canadians support sustainable finance policies, with 65% backing climate-aligned financial measures. CAFA has the support of over 120 civil society organizations and cross-party backing in the House of Commons. Please act to ensure CAFA progresses to the next stage. Thank you for your time. ———————————- Bonjour, Sénateur [Nom], Je m’appelle [Votre nom] et je suis membre de Citizens’ Climate Lobby Canada. J’appelle de [Ville/Province]. Je vous appelle pour vous demander de voter en faveur du projet de loi S-243, le Climate-Aligned Finance Act (CAFA), actuellement examiné par la commission bancaire du Sénat. En tant que sénateur, votre devoir constitutionnel est de protéger les minorités qui ne sont pas bien représentées dans la chambre élue. Aucun groupe n’est plus vulnérable et moins protégé que les enfants et les générations futures. Une action climatique rapide et audacieuse est essentielle pour les protéger, et le CAFA est le chaînon manquant pour aligner le secteur financier canadien sur nos objectifs climatiques. <<< Si vous faites partie des Sénateurs pour les solutions climatiques, j’espère que vous reconnaissez que le projet de loi S-243 est une solution clé pour le climat. Après plus d’un an de blocage en commission, je vous demande instamment d’aider à faire avancer ce projet de loi. >>> La plupart des Canadiens appuient les politiques de financement durable, et 65 % d’entre eux soutiennent les mesures financières axées sur le climat. L’ACFA bénéficie du soutien de plus de 120 organisations de la société civile et de l’appui de tous les partis à la Chambre des communes. Nous vous demandons d’agir pour que l’ACFA passe à l’étape suivante. Je vous remercie de m’avoir accordé votre temps. Traduit avec DeepL.com (version gratuite) Ideas for msg: Evidence of support for CAFA: Here are arguments for why CAFA is still necessary after OSFI’s B-15 guidelines (the only “regulation” that applies to banks regarding climate related financial risks)…. Basically existing regulation is about how climate risks will impact the financial institution, not how the financial institution is impacting the climate, which is what CAFA focuses on. OSFI is compelling firms to quantify and disclose their climate risks without actually taking action to limit the sources of that risk in the first place. OSFI’s guidelines are not ambitious or stringent enough to properly attenuate stranded asset risk in Canada’s financial system. In particular, we are concerned about the following overarching issues: Commissioner of Environment and Sustainable Development’s criticism of OSFI’s B-15: 2 reports from the Commissioner of the Environment point out that OSFI’s approach will not bring in the transition. CCL Canada’s CAFA Phone Zap and Lobby Campaign

Lobbying Resources

The lead person makes sure there is a biography of the parliamentarian in a document. Lobbyists meet before the lobbying session to review the document, assign roles in the meeting, the focus of their lobbying based on the most current “leave behind” and design possible motivational interviewing questions.Laser Talks

A majority of Canadians support climate-aligned financial policies. Recent polling shows that 65% of Canadians desire sustainable finance policies, with over 78% supporting measures to address greenwashing, and 80% expressing distrust in banks or financial institutions to deliver on their green promises.

Canada must implement robust climate-aligned financial policies to avoid falling behind. Indeed, international trading partners like the European Union, the United Kingdom, and Australiahave already adopted significant climate-aligned financial policies.

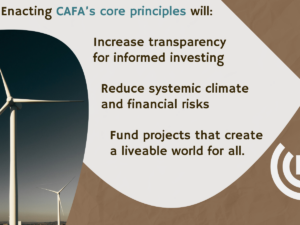

Canadians expect their elected officials to take decisive action on climate change, with the financial sector playing a key role. To this end, we would like to highlight the following principles from CAFA:

Phone Zap Suggested Dialogue

Background

Why CAFA is still necessary after OSFI’s B-15 guidelines

CCL Canada’s CAFA Phone Zap and Lobby Campaign

Home » CCL Canada News » CCL Canada’s CAFA Phone Zap and Lobby Campaign

Resources

![OPEN LETTER [closed]: Climate Aligned Finance Act II](https://canada.citizensclimatelobby.org/wp-content/uploads/2026/01/cafa-2026-featured-image-300x225.png)