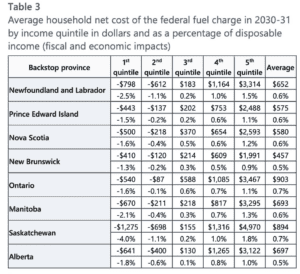

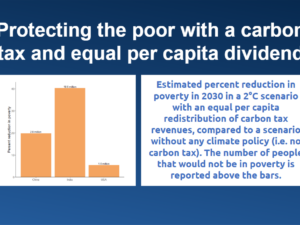

Brief Summary: Looking at direct and indirect costs alone, the newest Parliamentary Budget Office (PBO) report finds that the average household receives more back from the rebates than they pay. When layering on top of this a very limited view of the future economic impacts of the tax (one that ignores the costs of climate change and the benefits of a green economy), only the bottom-earning 40% will receive more back than they pay by 2030. Importantly, the estimates of the indirect costs are deeply flawed even by the PBO’s admission. Full text: Addressing an earlier error in their modelling, the Parliamentary Budget Office (PBO) updated their impact report on Canada’s carbon pricing policy in October 2024, revealing key improvements to the net fiscal benefits for households. “Considering only the fiscal impact of the federal fuel charge, PBO estimates that the average household in each of the backstop provinces (that is, all provinces except Quebec and British Columbia) in 2030-31 will see a net gain, receiving more from the Canada Carbon Rebate than the total amount they pay in the federal fuel charge (directly and indirectly) and related GST.” PBO Report (2024) What remains problematic is the report’s assessment of economic costs. While their outlook on the net fiscal and economic impacts for households improved since the last report (with the bottom-earning 40% now being shown to receive more back than they pay due to direct costs, indirect costs, AND future economic costs – as shown in Table 3) it still relies on a hypothetical scenario that doesn’t reflect real-world conditions and which the PBO takes pains to emphasise more clearly for its readers: this is compared to the cost of Canada doing nothing to reduce our emissions and facing no consequences from an overheating planet. Doing nothing to combat climate change does not mean paying nothing. In fact, it has severe consequences, as illustrated by extreme weather events like Hurricanes Helene and Milton in the United States, and the Jasper wildfires here at home. Furthermore, the report misses a critical feature of the policy: a stable and predictably rising carbon price is essential for driving investments in clean technology and creating jobs. There is a financial benefit to creating the market conditions which foster the world’s growing green economy. And it is an economy which our relatively small country is unlikely to capture without a strong price signal like carbon pricing at play. In summary, while the PBO report reaffirms that there are large progressive benefits for households from Canada’s carbon tax and rebate system, their estimates of its impacts on economic costs remain deeply flawed.

Laser Talk: The PBO’s latest word on carbon pricing

Home » CCL Canada News » Laser Talk: The PBO’s latest word on carbon pricing