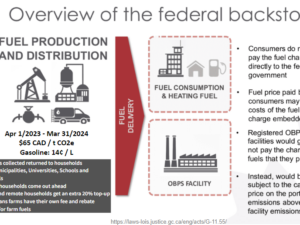

In March 2022, Canada’s Parliamentary Budget Office produced a report that unintentionally lead to more confusion and subsequent misinformation and disinformation. We have been lobbying our MPs, and we ran a campaign where over 300 letters were sent to our MPs and the PBO for a new and better study. But what question should that PBO answer in the next study? This is critical because all good problem-solving begins with a good question. Dr. Maenz walked through a rationale for a question the PBO should attempt to answer in a subsequent report. ACTION ITEM ARISING: In the first quarter of 2023 we will update our Leave Behind (lobbying ask) and to include a more refined question to the PBO, A Distributional Analysis of Federal Carbon Pricing under A Healthy Environment and A Healthy Economy Global greenhouse gas emissions and Canadian GDP: If we don’t do enough globally to avert climate disaster, then there is an additional 0.75% cut in GDP. This data pretty much concurs with the recent Canadian Climate Institute report. A discussion with Dr. David Maenz

About the Parliamentary Budget Office PBO report:

A Distributional Analysis of the Federal Carbon Pricing Under a Healthy Environment and a Healthy Economy

Wednesday, November 30, 2022.

Relevant PBO reports and summaries:

Take home message: The study accurately showed and reaffirmed that a majority of households will be better off financially as a direct result of the carbon tax and rebate. However, the analysis of the secondary economic impacts of carbon pricing will deliver a net loss to most households is flawed

The PBO’s claim that the secondary economic impacts of carbon pricing will deliver a net loss to most households is based on an incomplete picture of the economic benefits that climate action will bring for Canadians. In fact, the report doesn’t even attempt to show the real-world impact of carbon pricing on Canadian households. Rather, it shows how the carbon price would impact the economy in isolation.

https://www.pbo-dpb.gc.ca/en/blog/news/RP-2122-032-S–distributional-analysis-federal-carbon-pricing-under-healthy-environment-healthy-economy–une-analyse-distributive-tarification-federale-carbone-dans-cadre-plan-un-environnement-sain-une-eco

https://www.pbo-dpb.ca/en/publications/RP-2223-015-S–global-greenhouse-gas-emissions-canadian-gdp–emissions-mondiales-gaz-effet-serre-pib-canadien

Our current lobbying ask a.k.a. The Leave Behind