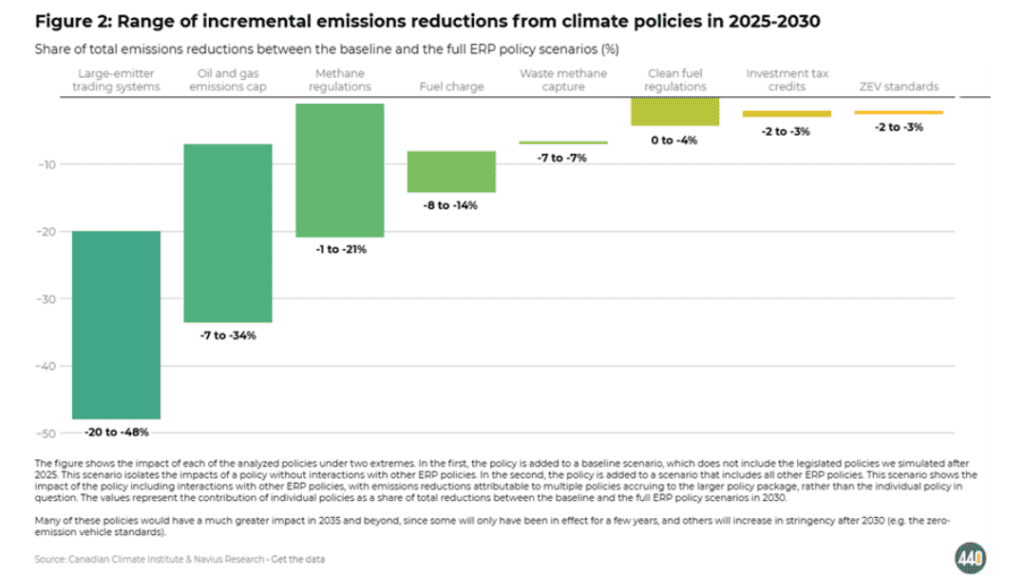

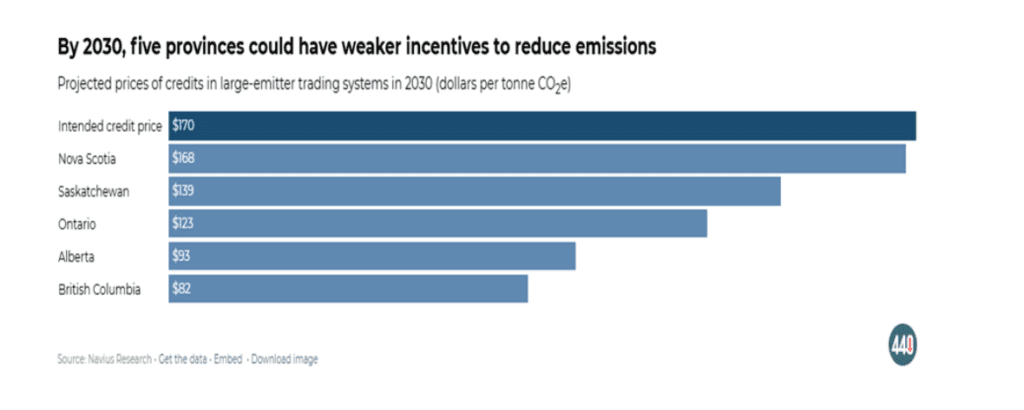

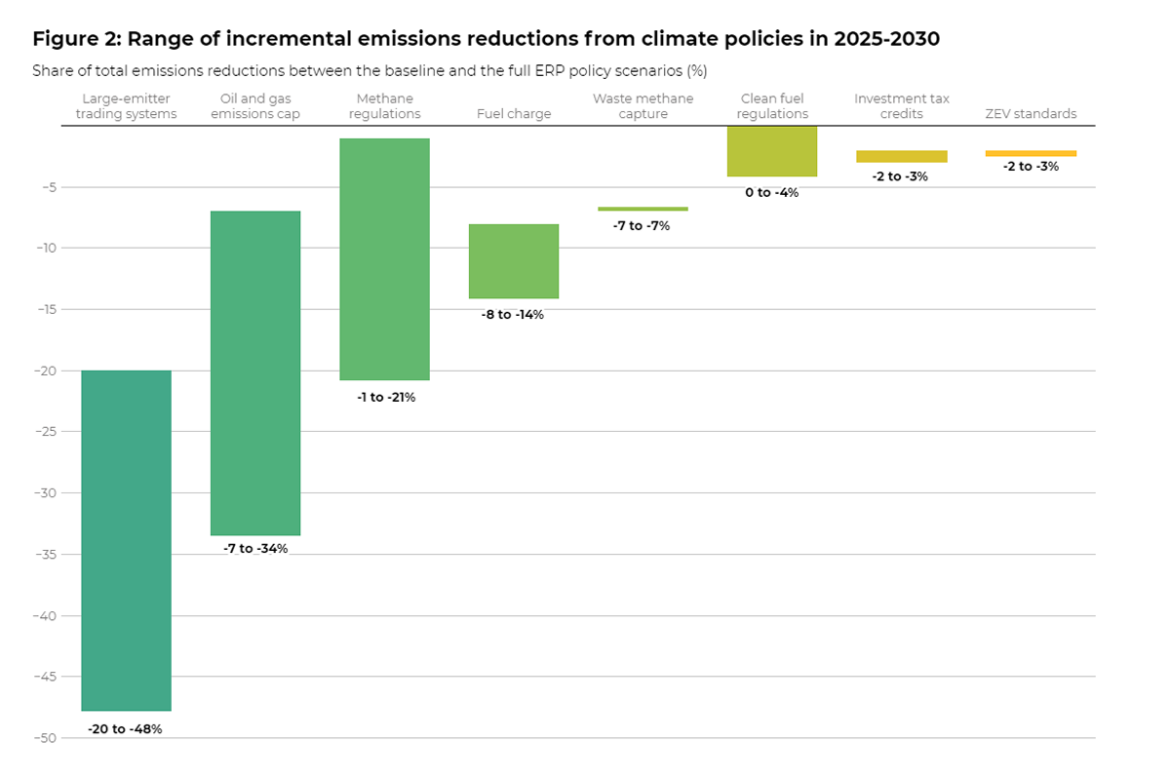

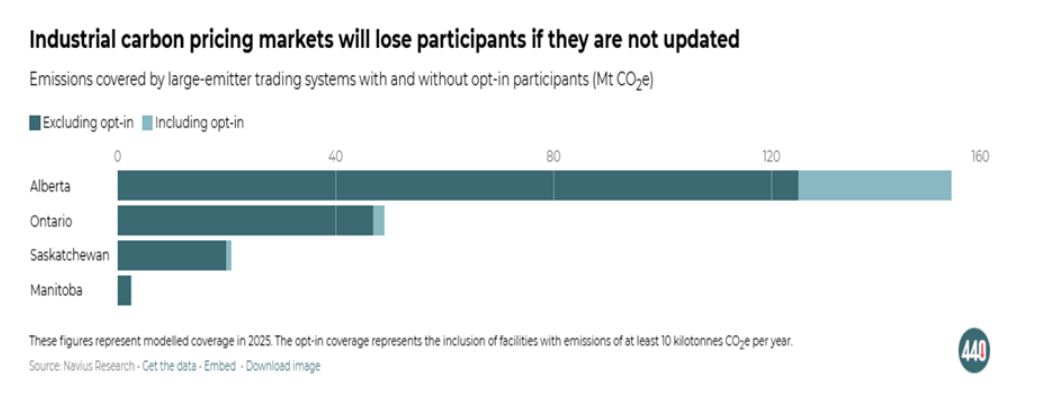

Takeaway: Industrial carbon pricing is the most effective way to lower carbon pollution; however, the Canadian government needs to continue to improve these systems to maximise their potential. The importance of industrial carbon pricing Under the Paris Agreement, Canada committed to lowering its greenhouse gas pollution output by 40–45% by 2030 (the target year for many of Canada’s climate policies to fulfil their emission reduction goals). According to a study by the Canadian Climate Institute and Navius Research, Which Canadian climate policies will have the biggest impact by 2030?, one climate policy in particular reduces carbon pollution the most. This policy is industrial carbon pricing. To illustrate this, the table below highlights the impact of eight major Trudeau government climate policies, of which, industrial carbon pricing (referred to here as large-emitters trading systems) had the largest estimated impact. How it works The large-emitter trading system (LETS) is a policy tool which regulates industrial carbon pricing. LETS incentivises industries to reduce their industrial carbon pollution output by setting a performance benchmark. Exceeding this emissions benchmark forces firms to purchase carbon credits. However, if firms pollute less than the threshold limit, they can sell their excess credits for profit to other firms. While this type of carbon market encourages firms to pollute less and allows them to profit by selling their carbon credits, it also has a minimal impact on Canadian households. In fact, an independent assessment published by the Canadian Climate Institute (CCI) shows that LETS has had a 0 per cent impact on household consumption in 2025, so far. While we do have LETS in place already, the large emitter trading systems are nowhere near perfect and require strengthening to maximise their potential. Oversupplying credits or keeping the price too low threaten the integrity of the system. In fact, CCI have raised a concern that if these issues are left unaddressed, “Canada could miss out on up to 48 megatonnes (Mt) of emissions reductions by 2030, slashing the impact of LETS by nearly half.” Challenges facing large-emitter trading systems Firstly, it is likely, the projected cost of carbon credits will decrease in the coming years. If the price of carbon credits falls, the incentive to reduce emissions weakens. The chart below highlights the projected price against the intended price of credits by 2030. With too many carbon credits in circulation, their cost will drop below the federal benchmark. This credit glut weakens the market, leading to weaker incentives for industries to invest and reduce pollution. It is crucial that the Federal government remains driven towards reaching the Greenhouse Gas Pollution Pricing Act’s scheduled carbon price target of $170 per tonne of CO₂ by 2030 to prevent this. Secondly, low participation is another challenge facing LETS success. This challenge has emerged after eliminating the federal fuel charge back in April 2025. Before this, opt-in facilities chose to pay either the federal fuel charge or participate in the carbon market. Choosing the latter option proved more profitable for these opt-in facilities. Even though an opt-in facility tends to be a smaller facility than a large-emitter site, on average, these opt-in facilities create “the same amount of greenhouse gases as 2,200 cars each year.” Now, these opt-in facilities can decide not to participate in LETS without worrying about paying the federal fuel charge. The chart below shows what the loss of opt-in facilities would mean for some Canadian provinces: If opt-in facilities leave the LETS markets, the loss is equivalent to 31 Mt worth of facilities or 9% of Canada’s carbon emissions in 2023. Another issue regarding large-emitter systems is transparency around key design choices like clarity, public disclosure, and pricing alignment. A lack of transparency makes it difficult to compare large-emitter systems and evaluate fairness. With government support, addressing these issues will only serve to strengthen LETS. The Output-Based Pricing System needs improved regulation. LETS functions through a carbon pricing framework known as Output-Based Pricing Systems (OBPS). There are a total of eleven different output-based emissions regimes (both federal and provincial) currently in use across the provinces and territories of Canada. This table outlines the various types of output-based pricing systems per province and territory: Having different versions of OBPS programs results in uneven carbon costs across the country, as stated by the 2020 Expert Assessment, which claims that “…marginal carbon incentives are not uniform across the country. Design choices that deliberately dilute the carbon price signal work against the overall effectiveness of a unified carbon pricing policy.” These cost incentives range from a low of $16 to a high of $41. The government has a lot of work to do to upgrade these systems. Aligning a national price floor will allow for credit trading transparency and help develop and clarify coordinated policy alignment. What is encouraging is that the new Liberal Party Canada leader, Mark Carney, has vowed to “improve the Output-Based Pricing System for large industrial emitters […] to ensure carbon markets continue to function well .” Conclusion It is important that CCL continues to encourage the Canadian government to keep good on their promise and strengthen the industrial carbon pricing system policy. The policy tools have proven to be highly effective, but need alignment and better regulation if Canada wants to stay on course and reach its emissions target by 2030. As we meet with our representatives throughout the coming year, we will be asking them to maintain and strengthen industrial carbon pricing with a steadily increasing price and increasing stringency in its application. Laser Talk: Importance of industrial carbon pricing and why it needs improvement

Province/Territory

System Type

Name of System / Notes

Applies To (Threshold)

British Columbia

Provincial – Tax + Performance-based

IER (Industrial Emissions Regulation) + Carbon Tax

Incentives via CleanBC; Tax rebates based on efficiency

Alberta

Provincial OBPS

TIER (Technology Innovation and Emissions Reduction)

≥100,000 tCO₂e/year (opt-in ≥10,000)

Saskatchewan

Provincial OBPS

SK OBPS

≥25,000 tCO₂e/year (opt-in ≥10,000)

Manitoba

Federal OBPS

Federal backstop applies

Standard federal threshold (≥50,000)

Ontario

Provincial OBPS

EPS (Emissions Performance Standards)

≥50,000 tCO₂e/year (opt-in ≥10,000)

Québec

Cap-and-Trade System

Cap-and-Trade (WCI)

≥25,000 tCO₂e/year

New Brunswick

Federal OBPS

Federal backstop applies

Standard federal threshold

Nova Scotia

Federal OBPS (since 2023)

NS Cap-and-Trade ended

Standard federal threshold

Prince Edward Island

Federal OBPS

Federal backstop applies

Standard federal threshold

Newfoundland & Labrador

Federal OBPS

Provincial tax covers fuels; federal OBPS covers industry

Standard federal threshold

Yukon

Federal OBPS (tailored)

Applies selectively

Large emitters, a few industrial sources

Northwest Territories

Territorial Carbon Tax (Modified OBPS)

No full OBPS; exemptions for small-scale industry

Applies via NWT Carbon Tax law

Nunavut

Federal OBPS

Applies in principle, but limited coverage

Few large industrial emitters