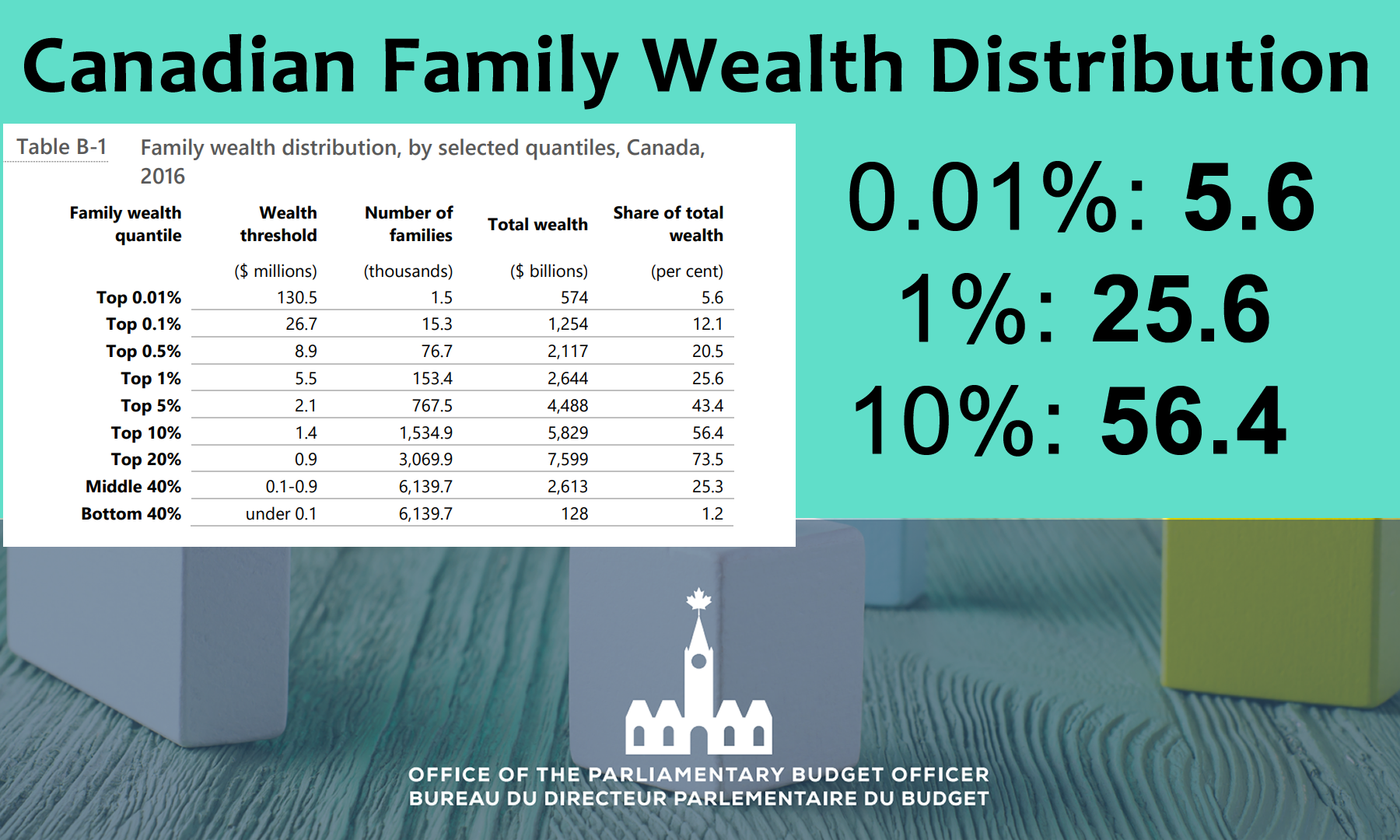

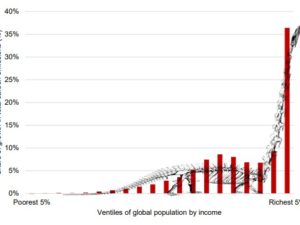

We are in the midst of a global pandemic. The COVID health crisis has set off economic shockwaves around the world and the climate crisis will be much worse. On September 9, 2020, the US Commodity Futures Trading Commission[2] issued a new and dire report, outlining the serious climate risk facing the US financial system. A major finding that stands out is that without a targeted, explicit price on carbon emissions, “financial markets will operate sub-optimally,” with capital helping to exacerbate both risk and cost, while failing to invest in more efficient systems and solutions. In June 2020, the Parliamentary Budget Office released a report on Canadian family wealth distribution[4] based on 15,349,000 families that collectively possess $10.3 trillion. The top 1.0 % quintile of Canadian families possess more than a quarter of all wealth in Canada, whereas the bottom 40% quintile possess just 1.2% of Canadian wealth. To balance the budget, the federal government must reform taxation to be more equitable and they have begun to do so. On September 23, 2020, there was a speech from the throne.[5] In the speech, the government indicated that ‘they will identify additional ways to tax extreme wealth inequality, including by concluding work to limit the stock option deduction for wealthy individuals at large, established corporations, and addressing corporate tax avoidance by digital giants.’ A tax overhaul has not been done in Canada since 1960s. According to the Charter of Professional Accountants, Canada is long due for an overhaul and should be moving to a low-carbon, and climate-resilient economy.[6] While there are many ways to reform taxation, the following four examples are possible avenues that have been mentioned by politicians and include details of the savings: Addressing the climate crisis, social concerns, and the budget deficit at the same time is doable. We can do this by improving carbon pricing, returning carbon pricing revenues to households and reforming taxation. REFERENCES [1] ” Climate change bigger economic risk than pandemic, ECB’s Schnabel says 31 August 2019, https://www.reuters.com/article/us-ecb-policy-schnabel-climate-idCAKBN25R1O0. Accessed 08 Sept 2020. [2] ” CFTC’s Climate-Related Market Risk Subcommittee Releases Report 9 September 2020, https://www.cftc.gov/PressRoom/PressReleases/8234-20 Accessed 08 Sept 2020. [3] ” Bridging the Gap 31 November 2019, https://ecofiscal.ca/wp-content/uploads/2019/11/Ecofiscal-Commission-Bridging-the-Gap-November-27-2019-FINAL.pdf. Accessed 08 Sept 2020. [4] ” Estimating the top tail of family wealth distribution in Canada. 17 June 2020, https://www.pbo-dpb.gc.ca/web/default/files/Documents/Reports/RP-2021-007-S/RP-2021-007-S_en.pdf Accessed 08 Sept 2020. [5] “Speech from the throne.” https://www.canada.ca/en/privy-council/campaigns/speech-throne/2020/speech-from-the-throne.html. Accessed 31 Oct 2020 [6] “Budget 2020 recommendations respond to call for low … – CPA Canada.” 12 Aug. 2019, https://www.cpacanada.ca/en/news/canada/2019-08-12-budget-2020-recommendations. Accessed 13 Aug. 2019. [7] Energy Policy Tracker for Canada https://www.energypolicytracker.org/country/canada/ . Accessed 9 Sept. 2020. [8] “Pipeline politics: Why $1.6 B in aid for oil and gas industry is – CBC.” 18 Dec. 2018, https://www.cbc.ca/news/thenational/national-today-newsletter-canada-oil-subsidies-us-politics-1.4950380. Accessed 28 Jun. 2019. [9] “December 11, 2017 The Right Honourable Justin Trudeau, PC … – IISD.” 11 Dec. 2017, https://www.iisd.org/gsi/sites/default/files/FINAL_G720Letter_FFsubsidies.pdf. Accessed 28 Jun. 2019. [10] “G20 Leaders Statement – G20 Information Centre – University of Toronto.” http://www.g20.utoronto.ca/2009/2009communique0925.html. Accessed 14 Aug. 2019. [11] “Reforming Subsidies Could Help Pay for Clean Energy Revolution ….” 17 Jun. 2019, https://www.iisd.org/media/subsidies-clean-energy. Accessed 13 Aug. 2019. [12] “Baby boomers under 75 set to inherit $750B in next decade … – CBC.” 6 Jun. 2016, https://www.cbc.ca/news/business/baby-boomer-inheritance-1.3617891. Accessed 28 Jun. 2019. [13] “Preliminary Findings on International Taxation.” 20 Jun. 2019, http://www.pbo-dpb.gc.ca/en/blog/news/preliminary-findings-on-international-taxation. Accessed 28 Jun. 2019. [14] “Liberals sidestep NDP call to close stock option tax loophole ….” 8 Feb. 2018, https://business.financialpost.com/pmn/business-pmn/ndp-to-force-vote-on-closing-stock-option-loophole. Accessed 13 Aug. 2019. LASER TALK: Balancing the Budget, Social Concerns, and the Climate

In early September 2020, Isabel Schnabel board member of the European Central Bank said[1], “The coronavirus pandemic demonstrates in the clearest terms why central banks must take a bigger role in fighting climate change even if the issue at first appears unrelated to monetary policy.”

To meet or exceed the 2030 target, Canada’s carbon price should continue to increase past[3]. To protect poor and middle-income families from increased energy costs, revenue from pricing carbon must be returned to households.

LASER TALK: Balancing the Budget, Social Concerns, and the Climate

Home » CCL Canada News » LASER TALK: Balancing the Budget, Social Concerns, and the Climate

LASER TALK: Balancing the Budget, Social Concerns, and the Climate

Posted on September 7, 2020 in Laser Talk