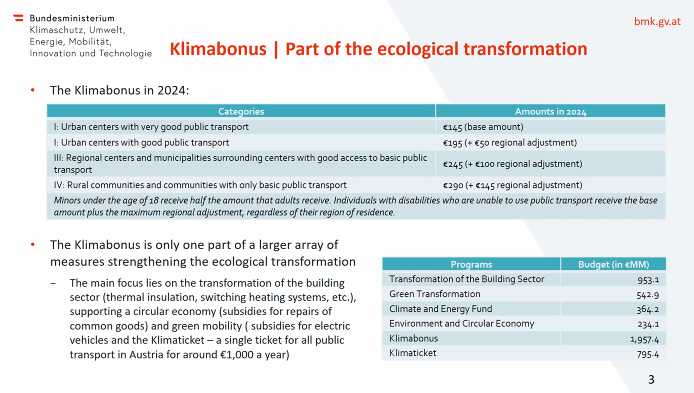

Answer: In autumn 2021, the Austrian Government introduced an “eco-social tax reform” with a goal to achieve NetZero by 2040. The main tool of this package is a national carbon fee applied on fossil fuels. The national scheme does not replace energy taxes, it’s in addition. It prices emissions outside the pre-existing EU-ETS by covering transport and buildings which accounts for a further 40% of GHG emissions. The Carbon pricing structure follows the logic of the EU Energy Taxation Directive (ETD), an “upstream” tax on production and importation. Products include: petrol, diesel, heating oil, coal, and natural gas, but the list could be expanded. Electricity is not subject to the policy because power plants above 20 MW of thermal output are covered by the existing EU-ETS. Initially, it will follow the following price path: €30 in 2022; €35 in 2023; €45 in 2024; and €55 in 2025. In 2026 it will align with the EU wide policy. This might become a market with allowances, like the EU-ETS, or it may be allowed to continue as it meets acceptable criteria. This will likely be defined in 2025. The Income (Dividend) is called “Klimabonus”. Austria has a great website for public explanation that directly promotes the financial benefit of choosing “climate friendly behaviour”. It is paid to all residents in Austria and rebates 100% of the carbon tax. In 2022, this is an equal payment of €500 per adult and €250 per child, and included a 2022 anti-inflation payment of €250. In 2023, regional access to public transport will be factored in. The bonus will increase as the carbon tax revenue increases. There are some compensations for industry covering: Agriculture and forestry. Sectors exposed to carbon leakage can get partial refunds; especially energy intensive industries identified in the EU as “at risk”. Also, particular “hardship” cases can be made. There are a set of related policy and tax changes to help with the transition that include: The Austrian Klimabonus (Climate Income) is a model policy for other EU Member States to copy under the EU Green Deal (Fit for 55 legislation). Question: Is there any extra info on the Klimabonus system? Answer: The Austrian government made it clear that every euro taken from the national ETS will be given back to the citizens through the Klimabonus. This makes sure that the increase in price by national ETS is sustainable for the population. The Klimabonus is given to all citizens resident in Austria. Adults receive a full part, while children under 18 receive a half-part. The Klimabonus is distributed yearly, through bank transfer or physical cheque for those who don’t have a bank. People living in rural areas use their car more and have a bigger house to heat up. To compensate for this reality, the Klimabonus will be varied to take account of geographical criterias. Two criterias are taken into account: the urban density (how far do I have to travel to go to the supermarket or the children’s school) and access to public transport (e.g. train or bus availability). The increase in the Klimabonus goes from +33%, +66% to +100%. A family living in a rural area can have up to twice the basic amount. The Klimabonus was distributed for the first time in 2022. Exceptionally, the amount of the Klimabonus was brought up at 250€, and was complemented by a 250€ anti-inflation payment. Starting 2023, the amount of the Klimabonus depends mechanically on what has been paid through the national price increase. The estimates are around 100€ per adult per year. In 2023, an urban family of four is expected to receive 300€, and the same family in the countryside up to 600€. As the carbon price will progressively rise, the annual amount of Klimabonus will rise mechanically. The Klimabonus is a smart way to make the national Carbon Price sustainable. Recycling the money throughout the Klimabonus guarantees the transparency and the sustainability of the system. Moreover, the Klimabonus is increased for people living in rural areas, which makes the measure more fair. ====================================================================== Question: What is Austria’s Klimabonus ?

In short: A strong and repeatable example of Climate Income (CF&D).

More info on the Klimabonus

In short: Every euro spent though the national ETS is given back to the citizens of Austria with the Klimabonus. It is paid yearly by bank transfer, and will be increased for families living in rural areas to take into account the inequalities in how they can change their habits. Klimabonus is transparent, simple and fair.

Laser Talk: The Austrian Klimabonus

Home » CCL Canada News » Laser Talk: The Austrian Klimabonus