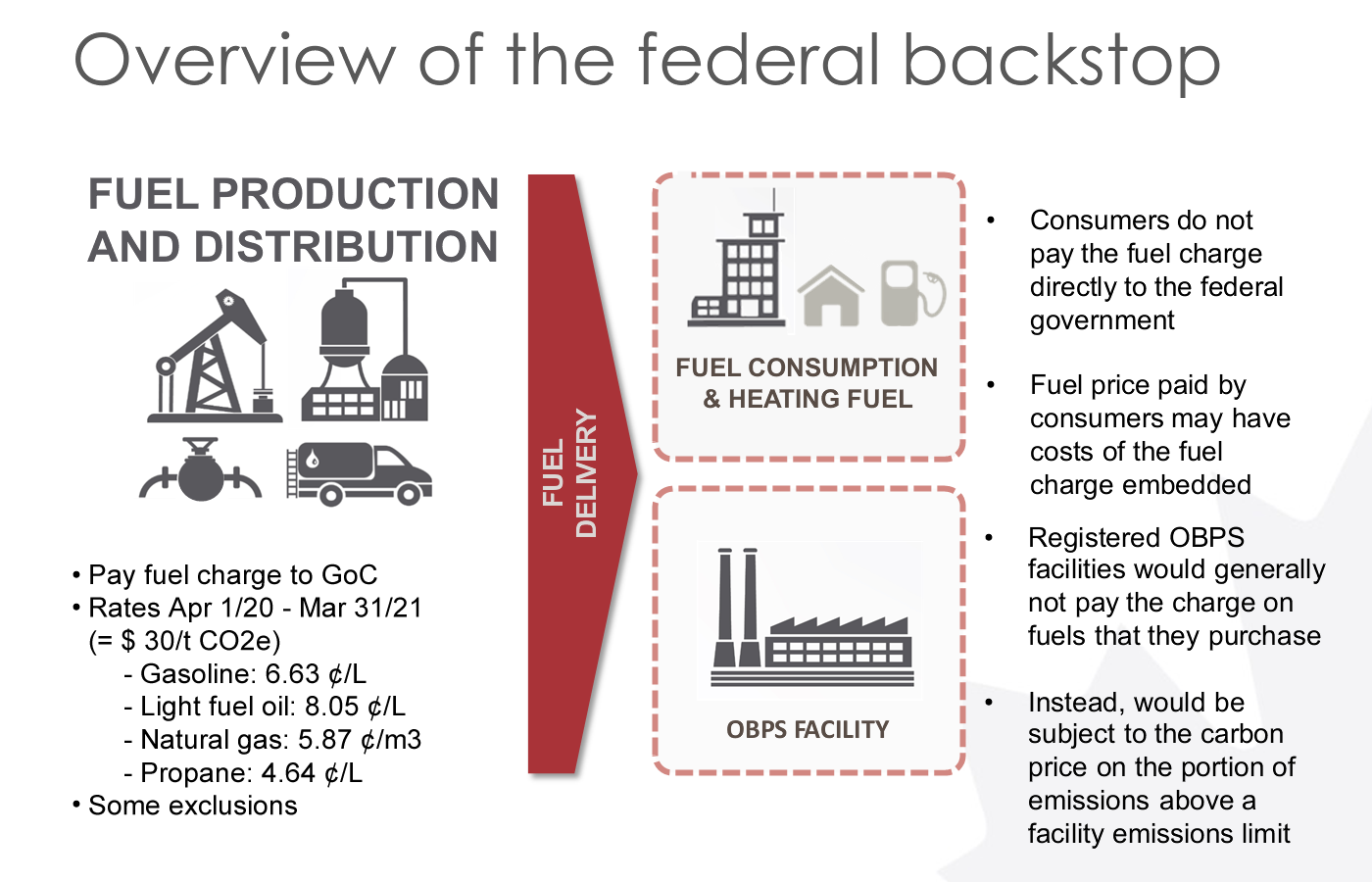

Preamble: Established in September 2010, Citizens’ Climate Lobby (CCL) Canada is a volunteer-based organization focused on national policies to address climate change. CCL Canada’s key focus from the beginning has been Carbon Fee and Dividend: an incrementally rising price on carbon pollution where 100% of the fees collected are returned to citizens. This revenue-neutral carbon pricing system is partly achieved by Canada’s Greenhouse Gas Pollution Pricing Act, 2018. The Act establishes a minimum national cost for Greenhouse Gas (GHG) emissions. It does so in two ways: The Act does not apply in provinces and territories that have adopted carbon pricing mechanisms that meet or exceed the national standards. Rather, the Act serves as a “Backstop”, applying only in those provinces and territories which have not adopted comparable standards or which voluntarily adopt the Federal Backstop. Where the Federal Backstop applies, the bulk of the fees collected under the Fuel Charge are returned to households, and 80% of households come out ahead, a finding confirmed by the Parliamentary Budget Officer and others. Tellingly, twenty-seven Nobel Prize-winning economists and thousands of economists worldwide support carbon pricing like we now have in Canada. Between September 2010 and March 2020, CCL volunteers recorded more than 1000 meetings with Parliamentarians and more than 3000 media hits. In 2016, CCL created a Carbon Pricing Guidelines document that delineated our expectations for a comprehensive Canadian carbon pricing policy. This is our March 2020 update of that document. In 2018 and 2019, the Intergovernmental Panel on Climate Change (IPCC) published three special reports: These reports unequivocally state that time is running out to reduce greenhouse gas (GHG) emissions and mitigate their impacts. Pivotally, these reports also indicated that with the right policies, including pricing carbon as a core component of a cost-effective climate plan, countries like Canada can become leaders in tackling climate change. In the past four years, Canada has made real progress. Many Canadian municipalities and the federal government have declared a climate emergency, put into law many climate policies (see Addendum), and put a national price on carbon pollution. In March 2020, the federal government initiated consultations with industry, First Nations, citizens, and other stakeholders to define what is considered an ‘ambitious’ plan to reach net-zero emissions in Canada by the year 2050. While these steps are a good start, much more needs to be done and with urgency. When the Trudeau government came to power in October 2015, they retained the former government’s woefully inadequate GHG emissions target (30% below 2005 level) and during Election 2019 made promises to strengthen the target. In 2019, using objective measures that assess actions, the Climate Performance Index ranked Canada 55th out of 61 countries for overall performance, noting our national climate targets are not in line with prevailing climate change science. As well, with the current suite of enacted policies, Canada is unlikely to reach even those inadequate targets. According to the Parliamentary Budget Officer and independent analyses, Canada’s carbon price must continue to rise beyond 2022 to achieve our Paris Agreement target. In this next decade, CCL will continue to lobby for an effective and predictably-rising carbon pricing policy in Canada. Below are guidelines for what we consider essential next steps to secure a liveable world: 1.The climate crisis is a non-partisan issue. We recommend a framework for cross-party cooperation through legislation of science-based GHG reduction targets and successive short-term (5 years or less) GHG budgets, with mandatory public reporting on progress in meeting these targets and budgets. The United Kingdom’s Climate Change Act 2008 provides an example of legislation which implements these concepts. 2. Based on the urgency of the climate crisis, economic modeling, case studies, and the need for a clear multi-year framework that allows households and businesses to make long term plans, we recommend that Canada’s national Backstop carbon price continue to rise past 2022, to at least $210 per tonne by 2030—thus going up at a rate of at least $20 per tonne per year from 2022 to 2030. 3.We strongly support that the Fuel Charge component of the Federal Backstop provides a direct dividend to households (the Climate Action Incentive payment) to protect low and middle-income households from higher costs. It is imperative that Canada’s carbon pricing system be fair and revenue-neutral. 4.The connection between the carbon price Canadians pay under the Fuel Charge component of the Federal Backstop and their dividend, which is paid through an income tax rebate, is unclear to many Canadians. To be more efficient at building the political will for the rising Backstop carbon price, we strongly recommend that Canadians receive their Climate Action Incentive payments at least twice yearly through a dividend cheque or a direct deposit in bank accounts. 5. We ask that the carbon price be economy-wide with minimal, principled and transparent exceptions and that all measurable GHGs be priced. 6. We appreciate that Canada’s Output-Based Pricing System for large emitters is providing a market signal to reduce GHG emissions and protects these vulnerable industries from unfair foreign competition. The climate emergency requires coordinated global action. Thus, we view the Output-Based Pricing System as temporary because we need mechanisms to encourage foreign countries to adopt their own carbon fees. Specifically, we recommend that Parliament study Border Carbon Adjustments as soon as possible and follow closely what the European Union is doing. Canada should continue to build support for carbon pricing internationally as was done for the Declaration on Carbon Pricing in the Americas, then enact Border Carbon Adjustments in cooperation with climate-friendly trading partners by 2022. 7. CCL’s stance has always been one carbon pricing policy for all of Canada. This is especially important in order to enact Border Carbon Adjustments which will require a uniform carbon price across Canada. Thus, we need the federal, provincial and territorial governments to cooperate in the development of a harmonized system of carbon pricing and if not possible, determine carbon pricing equivalencies between the different provincial and territorial carbon pricing mechanisms so that Canada can enact Border Carbon Adjustments. 8. We appreciate that the federal government has eliminated some fossil fuel subsidies since 2015, and recommitted to peer-review of Canada’s “inefficient” fossil fuel subsidies in 2018 at the G20 in Argentina after originally committing to doing so in 2009 at the G20 in Pittsburgh. Additionally, the Conservative Party of Canada during election 2019 indicated they might be supportive of eliminating some fossil fuel subsidies. We expect Canada to accelerate taking action as these subsidies are counterproductive, diminish public trust, and their removal has already been delayed for several years. 9. We appreciate that Canada is providing five million dollars for the World Bank’s Partnership For Market Implementation and also made a commitment of $300 million to the UN to the Green Climate Fund. We ask that Canada take even more leadership on tackling climate change globally, including by providing technical and financial support for the transition to clean energy economies in the Global South and by helping those most vulnerable adapt to changing conditions. 10. Overall, we recognize that carbon pricing needs to be woven into a comprehensive plan that includes: Although the societal wealth we currently enjoy would have been impossible without fossil fuels, we are transitioning out of a fossil fuel economy into a carbon-neutral economy. Strong policies are needed for such a transition to occur in the time that is available. This is where CCL contributes, to aid the timely implementation of these strong policies. Please work with us on our focus: a predictable and effective carbon pricing policy that leaves no one behind. Addendum – List of Canadian Climate Policies and Initiatives Pan-Canadian Framework on Clean Growth and Climate Change – December 2016 Greenhouse Gas Pollution Pricing Act June 21, 2018 2018 Methane regulations in the Oil and Gas Sector – April 2018 The Kigali Amendment to the Montreal Protocol – January 3, 2019 Their leadership in the Carbon Pricing Leadership Coalition, – November 2015 Canada Nature Fund Oil Tanker Moratorium Act 2019 Impact Assessment Act 2019 Founding members of the Carbon Pricing Leadership Coalition 2015 CCL Canada’s Carbon Pricing Guideline’s Document 2020 (pdf)CCL Canada’s Carbon Pricing Guidelines 2020

CCL Canada’s Recommendations

https://www.canada.ca/content/dam/themes/environment/documents/weather1/20170125-en.pdf

https://www.canada.ca/en/services/environment/weather/climatechange/pan-canadian-framework.html

https://laws-lois.justice.gc.ca/eng/acts/G-11.55/

Federal Climate Emergency Motion – June 18, 2019

https://www.cbc.ca/news/politics/climate-emergency-motion-1.5179802

https://globalnews.ca/news/5401586/canada-national-climate-emergency/

https://www.canada.ca/en/environment-climate-change/news/2018/04/federal-methane-regulations-for-the-upstream-oil-and-gas-sector.html

Fuel Efficiency Standards

https://www.nrcan.gc.ca/energy-efficiency/energy-efficiency-transportation/fuel-consumption-guide/21002

Canada’s New Food Guide- January 13, 2019

https://food-guide.canada.ca/en/

https://ottawacitizen.com/opinion/columnists/howard-and-hancock-canadas-new-food-guide-will-be-healthier-for-people-and-the-planet

The G7 Oceans Plastics Charter – On June 9, 2018

https://www.canada.ca/en/environment-climate-change/services/managing-reducing-waste/international-commitments/ocean-plastics-charter.html

Black Carbon Treaty / Gothenburg Principle – November 28, 2017

https://insideclimatenews.org/news/11042018/climate-treaty-gothenburg-protocol-air-pollution-regulations-global-warming-science-black-carbon-lrtap

https://www.canada.ca/en/environment-climate-change/services/pollutants/black-carbon-emissions-inventory.html

https://sdg.iisd.org/news/kigali-amendment-enters-into-force-bringing-promise-of-reduced-global-warming/

https://www.carbonpricingleadership.org/news/2016/7/14/twenty-canadian-companies-sign-on-to-carbon-pricing-leadership-coalition

Partnership For Market Implementation – December 8, 2019

https://www.worldbank.org/en/topic/climatechange/brief/partnership-for-market-implementation

https://www.canada.ca/en/environment-climate-change/services/nature-legacy/fund.html

https://openparliament.ca/bills/42-1/C-48/

https://laws-lois.justice.gc.ca/eng/acts/I-2.75/page-1.html#h-1160079

Memberships in International Coalitions:

https://carbonpricingdashboard.worldbank.org/

Members of the Carbon Neutrality Coalition

https://www.carbon-neutrality.global/plan-of-action/

Cofounders of Power Past Coal- November 16, 2017

https://www.canada.ca/en/services/environment/weather/climatechange/canada-international-action/coal-phase-out.html

CCL Canada’s Carbon Pricing Guideline’s Document 2020 (word)Please allow us time to translate this document. The many crises converging at this time have stretched us to our absolute limits and we must be kind to ourselves while we process collectively as a group the path forward. Thank you for your understanding.

CCL Canada’s 2020 Carbon Pricing Guidelines

Home » CCL Canada News » CCL Canada’s 2020 Carbon Pricing Guidelines