March 31, 2014

CONTACT: cathy@citizensclimatelobby.org 705-929-4043

IPCC REPORT ON CLIMATE IMPACTS

Great threat of climate change requires response similar to wartime

UN Panel’s March 31, 2014 report shows the need for Parliament to put aside differences and move toward a solution.

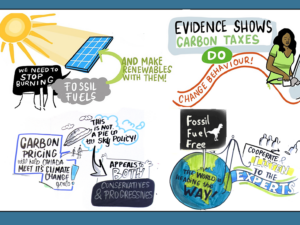

Common ground can be found in a carbon tax that gives revenue back to the people.

With the world’s leading experts giving their most dire warning yet on the impact of climate change, it’s time for Canada to move at wartime speed to reduce greenhouse gas emissions, starting with a revenue-neutral carbon tax.

The latest report from the Intergovernmental Panel on Climate Change could not be clearer or more emphatic: Our world is already seeing the disastrous effects of climate change, and things will get much, much worse in years to come if we do not swiftly reduce the greenhouse gas emissions that are literally drastically altering the Earth’s ecosystems and threatening global security.

The New York Times: “The report … concluded that ice caps are melting, sea ice in the Arctic is collapsing, water supplies are coming under stress, heat waves and heavy rains are intensifying, coral reefs are dying, and fish and many other creatures are migrating toward the poles or in some cases going extinct. The oceans are rising at a pace that threatens coastal communities and are becoming more acidic as they absorb some of the carbon dioxide given off by cars and power plants, which is killing some creatures or stunting their growth, the report found. Organic matter frozen in Arctic soils since before civilization began is now melting, allowing it to decay into greenhouse gases that will cause further warming, the scientists said. And the worst is yet to come, the scientists said in the second of three reports that are expected to carry considerable weight next year as nations try to agree on a new global climate treaty. In particular, the report emphasized that the world’s food supply is at considerable risk — a threat that could have serious consequences for the poorest nations. Nobody on this planet is going to be untouched by the impacts of climate change,” Rajendra K. Pachauri, chairman of the intergovernmental panel, said at a news conference releasing the IPCC report.

The report makes it clear, that no one is safe, yet it’s not hopeless. The only option is to cut emissions.

Despite our enormous political differences amongst North Americans, our history shows we are capable of coming together and achieving remarkable things when faced with great threats and challenges. Such was the case in stopping global tyranny during World War II

Today we face a threat greater than the fascism of the 20th Century and a challenge more daunting than putting a man on the Moon. We have the capacity to overcome the self-inflicted wounds of climate change and avoid a catastrophic future, but only if this crisis is met with similar urgency and effort.

Such urgency and effort requires that Conservatives, New Democrats, Liberals and Green Party members set aside their differences for the good of our nation and our world. That is yet to happen. Perhaps this is because Harper is waiting for the USA to act on the issue.

Prime Minister Harper’s climate policies have followed in lock-step with President Obama’s policies. Obama in turn has been directing the Environmental Protection Agency to develop regulations that will reduce greenhouse gas emissions from new and existing power plants. Republicans in the USA view new EPA rules as an expansion of government, are pushing back hard on the President’s effort.

PM Harper recently said that long-delayed regulations in the oil and gas sector will be announced “over the next couple of years”. Regulation will be increase taxes. As lawyer and carbon tax expert Dr. Shi-ling Hsu said, ‘”The upshot is that this is going to be a very complicated piece of regulation, putting a lot of lawyers to work. As a law professor, I guess that is good news. For the rest of you, it is a tax.”

As well, regulatory mechanisms are not market-based. In the absence of a market signal, it makes it difficult for investors to invest in clean energy. As well, Prime Minister has a lot of leeway to pick winners and losers in the energy sector depending on how the policies are written. Some might perceive a non-market-based solution for Canada’s energy sector as Ottawa favouring certain regions of Canada over others.

Rather than waiting for the USA and creating expensive regulatory rules for GHG emissions, we should embrace a market-based solution: Put a tax on carbon and give the revenue back to the people.

Conservative economist and Reagan Secretary of State George Shultz, has argued that the free market normally gravitates to things that are good for our society. There are times, however, when the price of something does not reflect its damage, the cost of which is borne by society. Such is the case with fossil fuels, whose price does not reflect the health, security and environmental costs that arise from their use. If we fix this price distortion – through a steadily-increasing tax – the market will gravitate toward cleaner energy and energy efficiency without the need for regulations or subsidies.

Detractors who argue against a carbon tax say it will kill jobs, drag down the economy and burden families with higher energy bills. But a well-designed carbon tax that recycles revenue back to households and into the economy would protect families from rising costs and actually add jobs. A recent study by Regional Economic Models, Inc. found that a carbon tax in California, even at very high levels, would increase GDP and add hundreds of thousands of jobs, provided the revenue is returned to the public, either as tax cuts or direct payments.

We have proof right here in Canada that a revenue-neutral carbon levy can cut emissions and create jobs. A study released by Analytica Advisors in early March 2014 found that between 2008, when British Columbia legislated a revenue neutral carbon tax, and 2010, the province’s clean technology sector grew by 48 per cent, their GHG emissions dropped and their GDP grew above the national average.

The other main argument against a carbon tax – that it will put Canadian businesses at a disadvantage with foreign competitors – can be easily dismissed by placing border tariffs on imports from nations that do not have an equivalent price on carbon. Energy and fossil fuel tariffs are allowable under the North American Free Trade Agreement (NAFTA) and would be viable under the World Trade Organization rules. Such tariffs would provide the incentive for other nations to adopt similar policies, making the revenue-neutral carbon tax a solution that is global in scope.

The health, food, security and economic costs of climate change – both now and in the future – far outweigh the costs of transitioning to a society that emits less and less greenhouse gases.

From the IPCC report: “Throughout the 21st century, climate-change impacts are projected to slow down economic growth, make poverty reduction more difficult, further erode food security, and prolong existing and create new poverty traps, the latter particularly in urban areas and emerging hotspots of hunger.”

A carbon tax with revenue refunded to households can speed the crucial transition to a low-carbon society AND have a positive impact on our economy.

Canada need not wait for the USA to act on the climate crisis. It’s time for lawmakers in Parliament to exhibit the kind of cooperation shown in previous times of great adversity by embracing this sensible solution: a revenue neutral carbon tax.