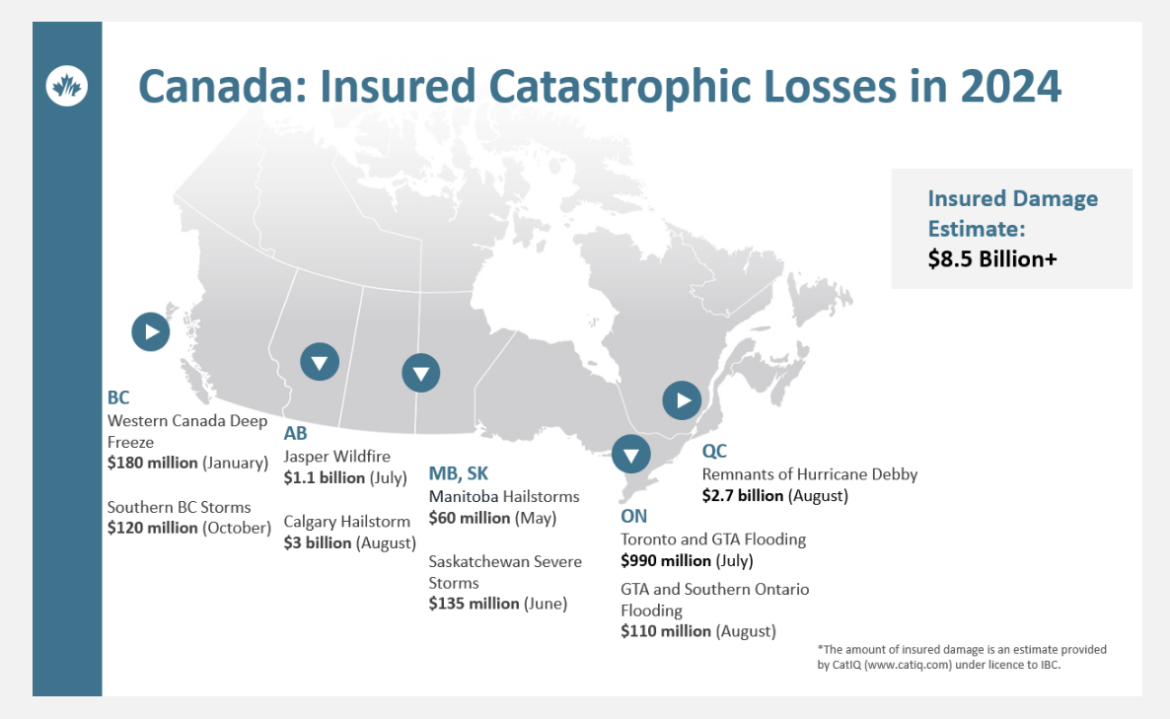

Takeaway: As climate change increases the frequency, severity, and unpredictability of extreme weather events, insurance companies are covering less and less of the costs. The burden is falling in larger part on taxpayers than ever before. In the United States, insurance companies such as State Farm, Farmers Insurance, Nationwide, Progressive, and Liberty Mutual (along with hundreds of other small insurance companies) have pulled out of states like Florida, Texas, Louisiana, and California, after experiencing the growing losses from their hurricanes, floods and wildfires. In some of those areas, state-backed insurers of last resort have become the only option, providing basic coverage when private companies deem areas too risky for new policies and renewals. In Canada, while the threat of insurance company withdrawal looms, rising insurance premiums are a greater burden with rates increasing by 7.7 per cent in 2023 alone, according to Statistics Canada, with premiums increasing and coverage diminishing as well. Over 1.5 million high-risk households cannot obtain affordable flood insurance in Canada. The year shattered records as Canada’s most expensive year for weather disasters, with extreme events affecting millions of lives. According to the Insurance Bureau of Canada, 2024 also shattered the record for the costliest year for severe weather-related losses in Canadian history at $8.5 billion. This is “nearly triple the total insured losses recorded in 2023 and 12 times the annual average of $701 million in the decade between 2001 and 2010”. Mitigation of these impacts will surely play a large role in diminishing our losses in the years to come. The Uninsurable World

The longer version: Wildfires. Floods. Drought. When climate change comes knocking at the door, who pays for the damage? More and more frequently, the answer is: Not insurance.

As the Intergovernmental Panel on Climate Change (IPCC) reports the cost of catastrophic weather events has risen exponentially in recent decades despite significant and increasing efforts to fortify infrastructure and enhance disaster preparedness during that time.

Yearly global economic losses from catastrophic events increased from $4 billion in 1950-1959 to a staggering $40 billion in 1990-1999. The insured portion of these losses rose from a negligible level to $9.2 billion during the same period. Today, figures from Swiss Re, a global reinsurance giant, show that insured losses from climate-driven devastation have now reached $50-billion in the first half of 2023 alone.

As the price and frequency of weather-related losses and payouts rise and the unpredictable nature of our worsening climate become realized, it has shown to result in a number of undesirable outcomes related to insurance:

– Insurance company bankruptcies

– Elevated consumer prices

– Increasing publicly funded compensation and relief (Damages paid directly with tax dollars) – Withdrawal of insurance coverage

As an ever increasing portion of these costs fall on taxpayers (whether through increases in direct payments or increases in tax dollars spent on coverage), the need for urgent climate action becomes clear.

Laser Talk: The Uninsurable World

Home » CCL Canada News » Laser Talk: The Uninsurable World