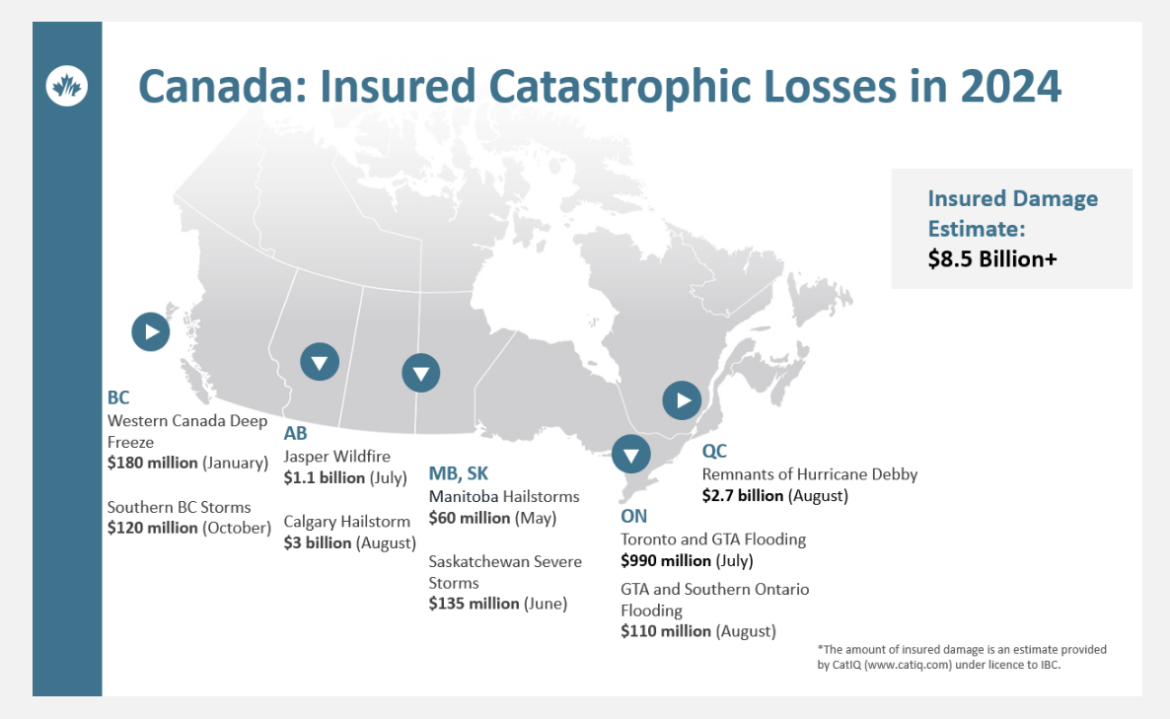

Takeaway: As climate change increases the frequency, severity, and unpredictability of extreme weather events, insurance companies are covering less and less of the costs. The burden is falling in larger part on taxpayers than ever before. The Intergovernmental Panel on Climate Change (IPCC) reports that the cost of catastrophic weather events has risen exponentially in recent decades, despite efforts to fortify infrastructure and improve disaster preparedness. Global yearly losses jumped from $4 billion in the 1950s to $40 billion in the 1990s, with insured losses climbing from negligible to $9.2 billion. Swiss Re data shows climate-driven insured losses hit $50 billion in just the first half of 2023. As weather losses grow and climate impacts intensify, the insurance market has seen troubling trends: In the U.S., companies State Farm, Farmers Insurance, Nationwide, Progressive, and Liberty Mutual (along with hundreds of other small insurance companies) have left states like Florida, Texas, and California after repeated hurricane, flood, and wildfire losses. State-backed “last resort” insurers now provide basic coverage where private firms refuse. In Canada, withdrawal hasn’t happened yet, but premiums rose 7.7 per cent in , while over 1.5 million high-risk households lack affordable flood insurance. The year 2024 wass Canada’s costliest for weather disasters—$8.5 billion in insured losses, nearly triple 2023’s total and 12 times the annual average from 2001–2010. As more costs shift to taxpayers, the case for urgent climate action grows. In March 2025, Allianz board member Günther Thallinger warned that entire asset classes are “degrading in real time” from extreme weather and that the climate crisis could destroy capitalism. Two-thirds of economic losses from natural disasters are already uninsured—a “major societal problem,” he told CNBC. Zurich Insurance Group echoed this concern in April 2025, calling the outlook “alarmingly bleak” and pointing to the Los Angeles wildfires as proof that even wealthy economies remain unprepared. Without rapid decarbonization and stronger resilience measures, the bill—for insurers, governments, and citizens—will only keep rising. Source: https://earth.org/financial-storm-how-escalating-climate-events-are-reshaping-the-insurance-market/ Our Uninsurable World

The longer version: Wildfires. Floods. Drought. When climate change comes knocking, who pays for the damage? Increasingly, the answer is: not insurance.

Laser Talk: Our Uninsurable World (Updated August 2025)

Home » CCL Canada News » Laser Talk: Our Uninsurable World (Updated August 2025)