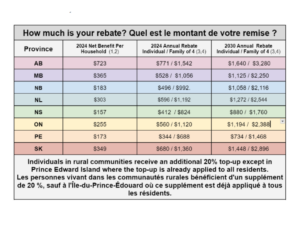

This letter was sent on June 19 to the government of Canada. INCOME INEQUALITY Canada has not had a tax overhaul in over 50 years. Canada can address this income inequality issue and can do so through tax reform. This not our area of expertise. Thus, we ask the government of Canada to follow the advice of experts. CANADA IS A CLIMATE LAGGARD IMAGE: https://bit.ly/2OHAgYY WE ARE IN A CLIMATE EMERGENCY CARBON PRICING At Citizens’ Climate Lobby, our focus for a decade has been building the political will for Carbon Fee and Dividend: an incrementally rising price on carbon pollution where 100% of the fees collected are returned to citizens. Canada’s national backstop carbon pricing policy is a form of Carbon Fee and Dividend. Tellingly, 27 Nobel Prize-winning economists and thousands of economists worldwide support Carbon Fee and Dividend. Canada’s carbon pricing policy puts money in people’s pockets. The fact is, 80% of households come out ahead, a finding confirmed by the Parliamentary Budget Office and others. Thus, now is the time to ramp up the carbon pricing. Canada must increase the national carbon price past 2022 to at least $220 per tonne by 2030. The carbon price must continue to be revenue-neutral. To make the carbon price less susceptible to attacks by the climate denialists, Canadians must receive our Climate Action Incentive rebates at least twice yearly through a dividend cheque or a direct deposit. The carbon price must be economy-wide with minimal, principled exceptions and all measurable greenhouse gases (GHGs) must be priced. CLIMATE ACCOUNTABILITY Please note these ideas about climate accountability are still being formulated by Citizens’ Climate Lobby Canada. We will be looking to our membership, Canadian NGOs, and our Parliamentarians to guide us as we cooperate together to respond to the climate emergency we are in and embrace the opportunities together. OTHER RECOMMENDATIONSSUBMISSION TO THE CANADIAN RESPONSE TO THE COVID PANDEMIC

Citizens’ Climate Lobby Canada

CCL Canada Submission to COVID Pandemic June 19, 2019

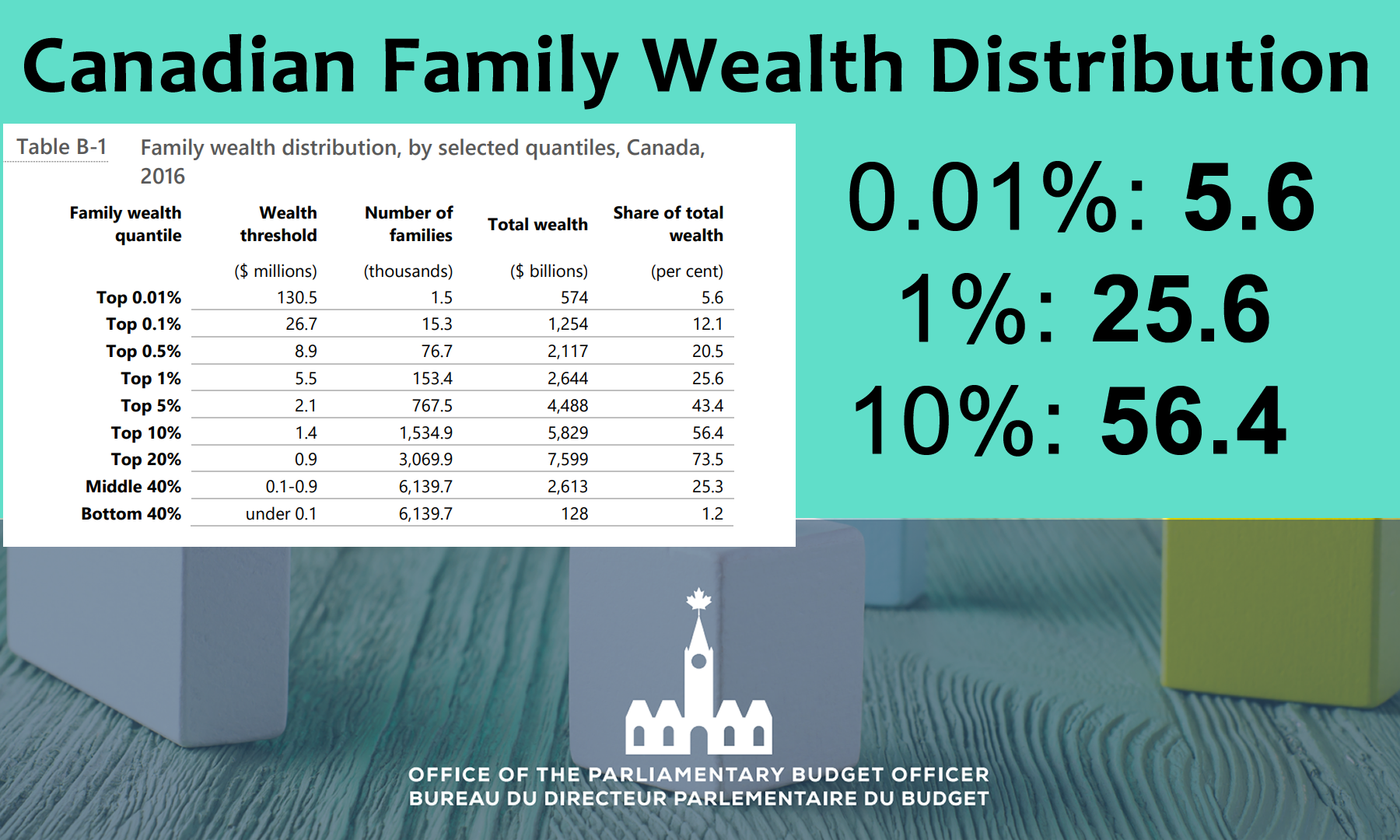

During the 2019 federal election, the Parliamentary Budget Office (PBO) estimated the financial cost of electoral proposals of political parties upon request. One such request was made to estimate the fiscal revenues of an annual tax on the net wealth of high-net-worth families above $20 million. The PBO set out to measure High-net-worth Family Database (HFD). HFD was constructed using publicly available data from year-end 2016, the most recent date all sources reported data. The calibrated HFD represents approximately 15,349,000 families that collectively possess $10.3 trillion. As can be seen in the table below the top 1% of Canadians possess 25% of the total wealth of Canada and bottom 40% possess 1.2% of the total wealth of Canadians. From this data, one can conclude that there is an income inequality issue in Canada

Canada has never met a climate target. Why? Because our laws to protect the environment are insufficient and our democracy is susceptible to the climate denial machine making it very difficult to enact laws that will protect future generations. Canada should look to the United Kingdom and its Climate Change Act (2008) on how to address create climate accountability laws.

Now is the time to act. Just this week, Fatih Birol, executive director of the International Energy Agency warned the world has only six months in which to change the course of the climate crisis and prevent a post-lockdown rebound in greenhouse gas emissions that would overwhelm efforts to stave off climate catastrophe. “This year is the last time we have if we are not to see a carbon rebound”.RECOMMENDATIONS:

Post-COVID Canada must climb out of huge debt, address income inequality, and tackle the climate emergency. This can be done. When he regained power in 1935 during the Great Depression, Prime Minister William Lyon Mackenzie King implemented relief programs such as the National Housing Act and National Employment Commission similar to or even modeled after the New Deal of US President Franklin D. Roosevelt. The objective was to put money in the pockets of the common people and it worked. We need to do the same again today.

Canada is a confederation and has a Westminster model of democracy. Thus, both must be considered with design climate accountability laws. We want Canada’s climate accountability laws to look like we are in an emergency because we are in an emergency. There is also some keen advice from Canadian NGOs to consider. Here are some general elements we think should be in a climate accountability law for Canada:

Climate Accountability Resources

http://www.legislation.gov.uk/ukpga/2008/27/contents

https://www.ecojustice.ca/wp-content/uploads/2020/06/Policy-Brief-New-Canadian-Climate-Accountability-Act-1.pdf

https://climatechoices.ca/reports/marking-the-way/

https://www.wcel.org/sites/default/files/publications/CarbonBudget%20(Web)_0.pdf

https://www.facebook.com/climate.action.network.canada/videos/695300614375147/?t=3

Overall, we need a comprehensive plan that includes:

OPEN LETTER: Submission to the Canadian Response to the COVID Pandemic

Home » CCL Canada News » OPEN LETTER: Submission to the Canadian Response to the COVID Pandemic

OPEN LETTER: Submission to the Canadian Response to the COVID Pandemic

Posted on June 20, 2020 in Open Letter