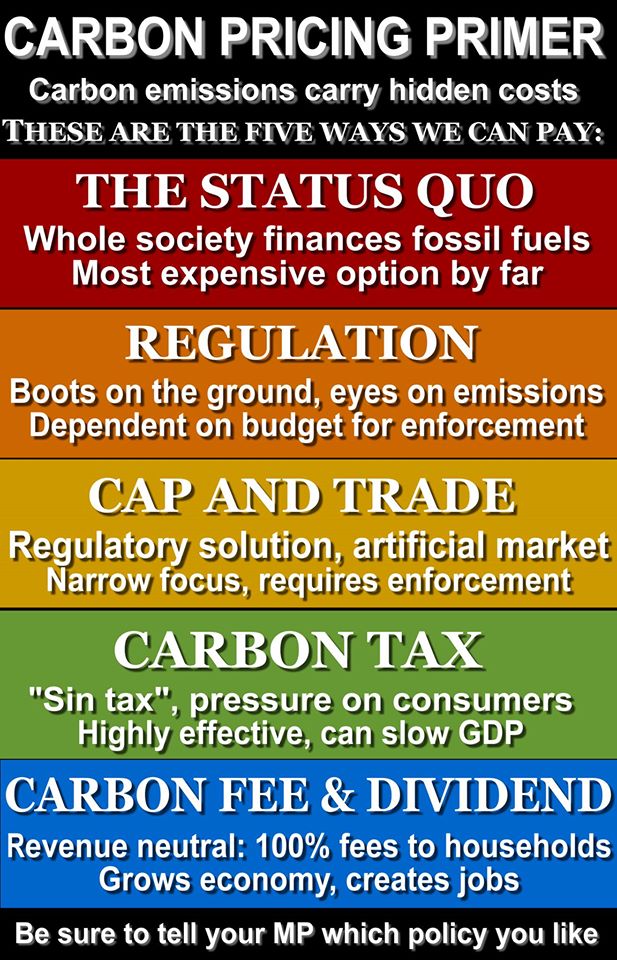

There are five ways to price carbon. They are listed here from least transparent to most transparent: i) The Status Quo: external costs of climate change are not internalized and the taxpayer is forced to pay for climate and health-related damages. ii) Regulation: sector by sector regulation of all the sectors in the economy that produce carbon pollution.(1) iii) Cap and Trade: put a mandatory limit (or “cap”) on some portion of national emissions, and allow firms to buy and sell rights to emit within the cap as well. This can be with or without offsets. A carbon offset is a reduction in emissions of carbon dioxide or other greenhouse gases made in order to compensate for an emission made elsewhere.(2) iv) Carbon Tax: a tax based on greenhouse gas emissions generated from burning fuels. The tax may or may not be revenue neutral. A revenue neutral tax is one that does not have a net increase in overall federal tax revenues.(3) v) Carbon Fee and Dividend: An incrementally increasing fee is placed on carbon pollution and 100% of the money is returned to households. The term fee is used deliberately to indicate clearly that it is a revenue neutral pricing system. Carbon Fee and Dividend, as proposed by Citizens Climate Lobby, is an upstream fee and is levied at point of production of fossil fuels (at the well head, mine or point of entry). A downstream tax, on the other hand, would be levied at the point of consumption of fossil fuels and/or products dependent on fossil fuels. (4) NOTES: (1) Examples of regulation are emission standards for cars and for coal-fired power plants. (4) Legislators in California passed AJR 43 on September 1, 2016. AJR 43 is a joint resolution urging the federal government to enact a revenue-neutral tax on carbon-based fossil fuels and return revenue from the tax back to middle- and low-income households.

(2) Quebec, California and the European Union are jurisdictions that have implemented cap and trade with offsets to mitigate their greenhouse gas emissions. The Liberal government in Ontario chose cap and trade in the spring of 2015 as its carbon pricing policy. Ontario plans to roll its Cap and Trade plan in 2017, link up with California and Quebec in 2018 and industries must give a full accounting (“true-ups”) in 2021. Download the November 2015 report (Power Point) from the Ontario Ministry of Environment and Climate Change here.

(3) British Columbia, Alberta, Norway and Sweden have carbon taxes. On Monday, October 3, 2016, Prime Minister Justin Trudeau announced that Canada will establish a floor price on carbon pollution of $10 a tonne in 2018, rising to $50 a tonne by 2022.

LASER TALK: The Five Chief Ways to Price Carbon

Home » Laser Talks » LASER TALK: The Five Chief Ways to Price Carbon