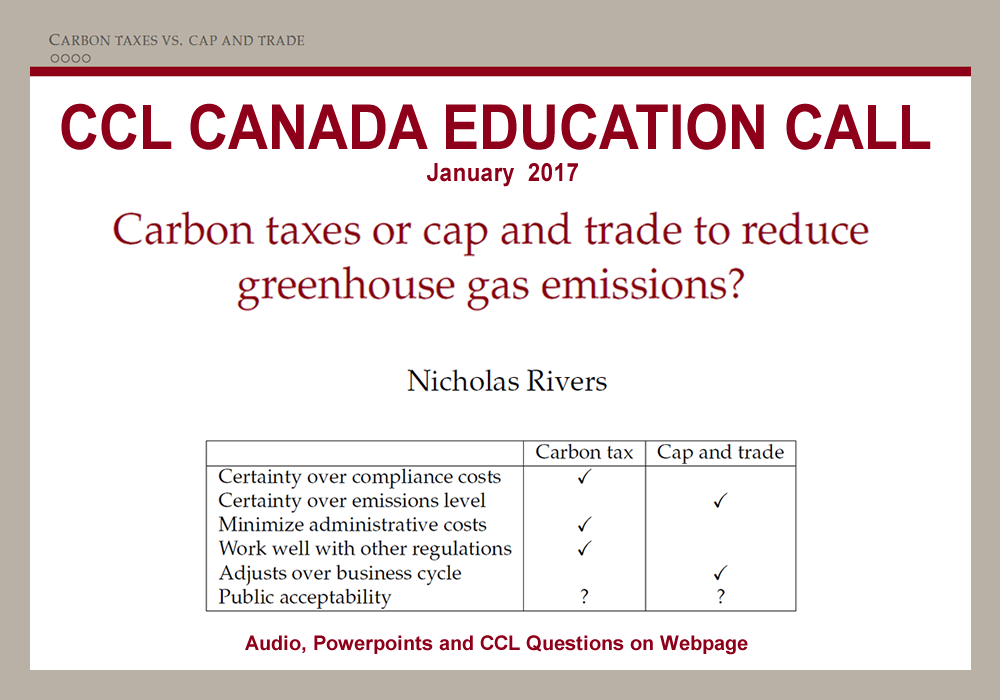

CCL Canada Education: CARBON TAXES OR CAP AND TRADE TO REDUCE GREENHOUSE GAS EMISSIONS

Dr. Nicholas Rivers, Tuesday, January 24, 2017

Nicholas Rivers is the Canada Research Chair in Climate and Energy Policy. His research focuses on the economic evaluation of environmental policies, using econometric and computational methods. He has received awards for his research from the Trudeau Foundation, the Social Science and Humanities Research Council, and the National Science and Engineering Research Council. He currently serves as a co-editor of the Journal of Environmental Economics and Management. He earned his Master’s and doctorate degrees in Resource and Environmental Management at Simon Fraser University in Vancouver, British Columbia, and also holds a Bachelor’s degree in Mechanical Engineering.

Nicholas Rivers is the Canada Research Chair in Climate and Energy Policy. His research focuses on the economic evaluation of environmental policies, using econometric and computational methods. He has received awards for his research from the Trudeau Foundation, the Social Science and Humanities Research Council, and the National Science and Engineering Research Council. He currently serves as a co-editor of the Journal of Environmental Economics and Management. He earned his Master’s and doctorate degrees in Resource and Environmental Management at Simon Fraser University in Vancouver, British Columbia, and also holds a Bachelor’s degree in Mechanical Engineering.

CCL Questions:

QUESTION: However, since we still have a long way to go, my question to you is, despite the fact that they are currently doing better than any of the other provinces in GHG reduction, how could ON and QC get their price per permit up or reduce their emissions even more, given that they use a trading system with California?

#4: CATHY ORLANDO SUDBURY: What complementary policies directly related to carbon pricing could provinces enact to get emissions down?.

Our Next CCL Education Call will be Tuesday, February 28, 2017 at 1 pm PT / 4 pm ET on the Canadian Uberline.