Canada must climb out of a mountain of financial debt from the COVID pandemic during a war in Europe while addressing the climate emergency with socially just policies. Luckily for Canadians, our Parliamentary Budget Office (PBO) provides independent, authoritative and non-partisan financial and economic analysis to help us all chart the path forward. Estimating The Top Tail Of The Family Wealth Distribution In Canada (2020) Revenue Estimates Of M-68: One-time Tax On Extreme Wealth (July 2021) Beyond Paris: Reducing Canada’s GHG Emissions by 2030 (June 2021) A Distributional Analysis of Federal Carbon Pricing under A Healthy Environment and A Healthy Economy Global greenhouse gas emissions and Canadian GDP: If we don’t do enough globally to avert climate disaster, then there is an additional 0.75% cut in GDP. This data pretty much concurs with the recent Canadian Climate Institute report.LASER TALK: Important Reports from Canada’s Parliamentary Budget Office

Take home message: income inequality exists in Canada

In June 2020, the Parliamentary Budget Office released a report on Canadian family wealth distribution. Collectively, 15,349,000 families possess $10.3 trillion. The top 1.0 % quintile of Canadian families possess more than a quarter of all wealth in Canada, whereas the bottom 40% quintile possess just 1.2% of Canadian wealth.

https://www.pbo-dpb.gc.ca/web/default/files/Documents/Reports/RP-2021-007-S/RP-2021-007-S_en.pdf

Fiscal and Distributional Analysis of the Federal Carbon Pricing System (2019)

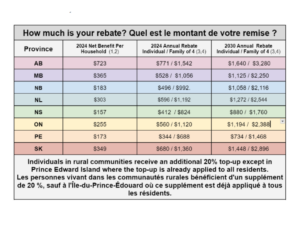

Take home message: the federal carbon pricing is progressive and will reduce income inequality

Canada’s carbon pricing system is revenue neutral; any revenues generated under the system will be returned to the province or territory in which they are generated. Households will receive 90 percent of the revenues raised from fuel charges. A typical household will receive higher transfers than the average amounts it pays in fuel charges. The net benefits are broadly progressive by income group. That is, lower-income households will receive larger net transfers than higher-income households.

https://www.pbo-dpb.gc.ca/web/default/files/Documents/Reports/2019/Federal%20Carbon/Federal_carbon_pricing_EN.pdf

https://www.cbc.ca/news/politics/parliamentary-budget-officer-carbon-price-revenues-1.5110618

Preliminary Findings on International Taxation (2019)

Take home message: there are significant sums of revenue to be found in tax havens.

The Parliamentary Budget Officer calculated that in 2018, Canadian corporations may have avoided $25 billion dollars or more in taxes through tax havens.

https://www.pbo-dpb.gc.ca/web/default/files/Documents/Reports/2019/Preliminary-Findings-International-Taxation/Report%20final.pdf

Take home message: Canada could look to a one-time extreme wealth tax for raising revenue.

A one-time 3% tax on Canadians with net wealth over $10 million, and a 5% tax on net wealth over $20 million could raise up to $82.5 billion over five years.

https://distribution-a617274656661637473.pbo-dpb.ca/a2d27dbe13ecedf7ebdac816acc5ddb4ab59d297dcbd77caddd75a346472afb7?fbclid=IwAR0Mf7BebgzBQT5osWxwvottnMsaDykcvV_lE6fm4oLdoYiXZdjHcGmNYzs

Take home message: Carbon pricing is going to do a lot of the heavy lifting to reduce GHG emissions by 2030, but it can’t do it alone. As well, overlapping the output-based carbon pricing (OPBS) and border carbon adjustments (BCA) systems will be complicated.

Increasing the federal fuel charge to $170 per tonne and tightening OBPS will help Canada achieve over half of the 168 Mt reduction projected in Budget 2021 (96 Mt). Nonetheless, significant reductions from less visible non-price policies, already announced, will be needed to reach that objective. Budget 2021 also proposes BCAs to ensure that imports coming into Canada are priced for the carbon emissions that they induced in production. In principle, the BCAs and OBPS are substitutes since they both seek to level the playing field between Canada and the rest of the world. In practice, however, they are both complements and substitutes, and using both creates significant complications.

https://distribution-a617274656661637473.pbo-dpb.ca/1df9b64ac4e1885028a02c05d5f15b82622d3ace28a473159d59301fb636c6e3

Take home message: The study accurately showed and reaffirmed that a majority of households will be better off financially as a direct result of the carbon tax and rebate. However, the analysis of the secondary economic impacts of carbon pricing will deliver a net loss to most households is flawed

The PBO’s claim that the secondary economic impacts of carbon pricing will deliver a net loss to most households is based on an incomplete picture of the economic benefits that climate action will bring for Canadians. In fact, the report doesn’t even attempt to show the real-world impact of carbon pricing on Canadian households. Rather, it shows how the carbon price would impact the economy in isolation.

https://www.pbo-dpb.gc.ca/en/blog/news/RP-2122-032-S–distributional-analysis-federal-carbon-pricing-under-healthy-environment-healthy-economy–une-analyse-distributive-tarification-federale-carbone-dans-cadre-plan-un-environnement-sain-une-eco

https://www.pbo-dpb.ca/en/publications/RP-2223-015-S–global-greenhouse-gas-emissions-canadian-gdp–emissions-mondiales-gaz-effet-serre-pib-canadien

LASER TALK: Important Reports from Canada’s Parliamentary Budget Office

Home » CCL Canada News » LASER TALK: Important Reports from Canada’s Parliamentary Budget Office

LASER TALK: Important Reports from Canada’s Parliamentary Budget Office

Posted on July 27, 2021 in Laser Talk